Oil prices can be influenced by many factors, but the most crucial among them are supply, demand and storage capacity.

That’s because like any other commodity, oil follows a production cycle.

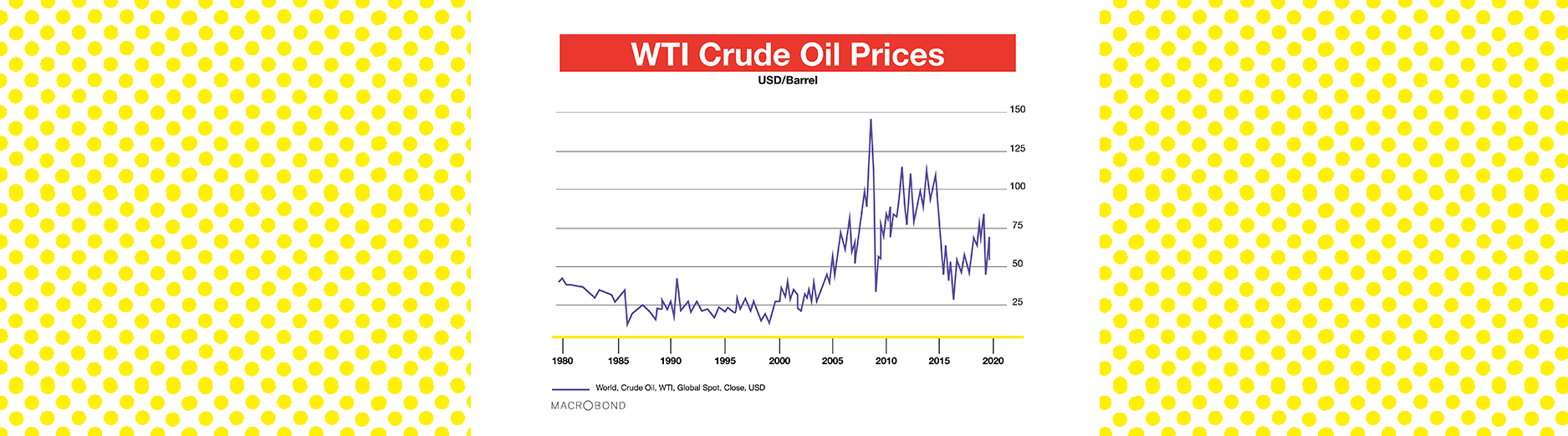

When demand increases faster than supply, the oil price spikes upwards in a straight line. The demand curve moves up when the economy improves or new consumers appear.

With higher prices and more possibilities to make money off oil, capital pours into the industry and spending on exploration and production increases.

Inevitably, higher production leads to lower prices as the expansion in supply outstrips demand. The supply curve moves up as the demand curve holds steady, and prices adjust accordingly.

The difference between oil and other commodities is the limited ability to store oil. In a low oil price environment, when supply overwhelms demand, once storage is full, the price of oil will plummet because buyers don’t have room to take in or house the oil they purchased. Even if they want to keep buying oil to take advantage of the price, they have nowhere to put it.

In the most extreme example in history to date, the COVID-19 pandemic in 2020 cratered demand so quickly that supply could not adjust. The futures went negative as holders of the contract could not take physical delivery of the underlying oil and sold to those who could.

The interplay between supply and demand has always been one of the key factors to impact oil prices, but outside elements like geopolitical risk or economic instability caused by a one-time event like a pandemic can temporarily offset an already delicate balance, highlighting an inherit risk (and benefit) of commodities: the price swings in either direction can be much more dramatic than they would be for stocks.