Financial Pipeline

Why Canada’s investable universe is shrinking – and how to start reversing this trend

While increasing investment in Canada may seem like a simple solution to shrinking capital markets, there are several factors that make turning that idea into a reality more complex than investors may realize – which means it’s crucial to do it right.

Merged vs. separate accounts

Love may be shared, but should bank accounts be? Explore the pros and cons of merged and separate accounts – and how to find the right balance for your financial future together.

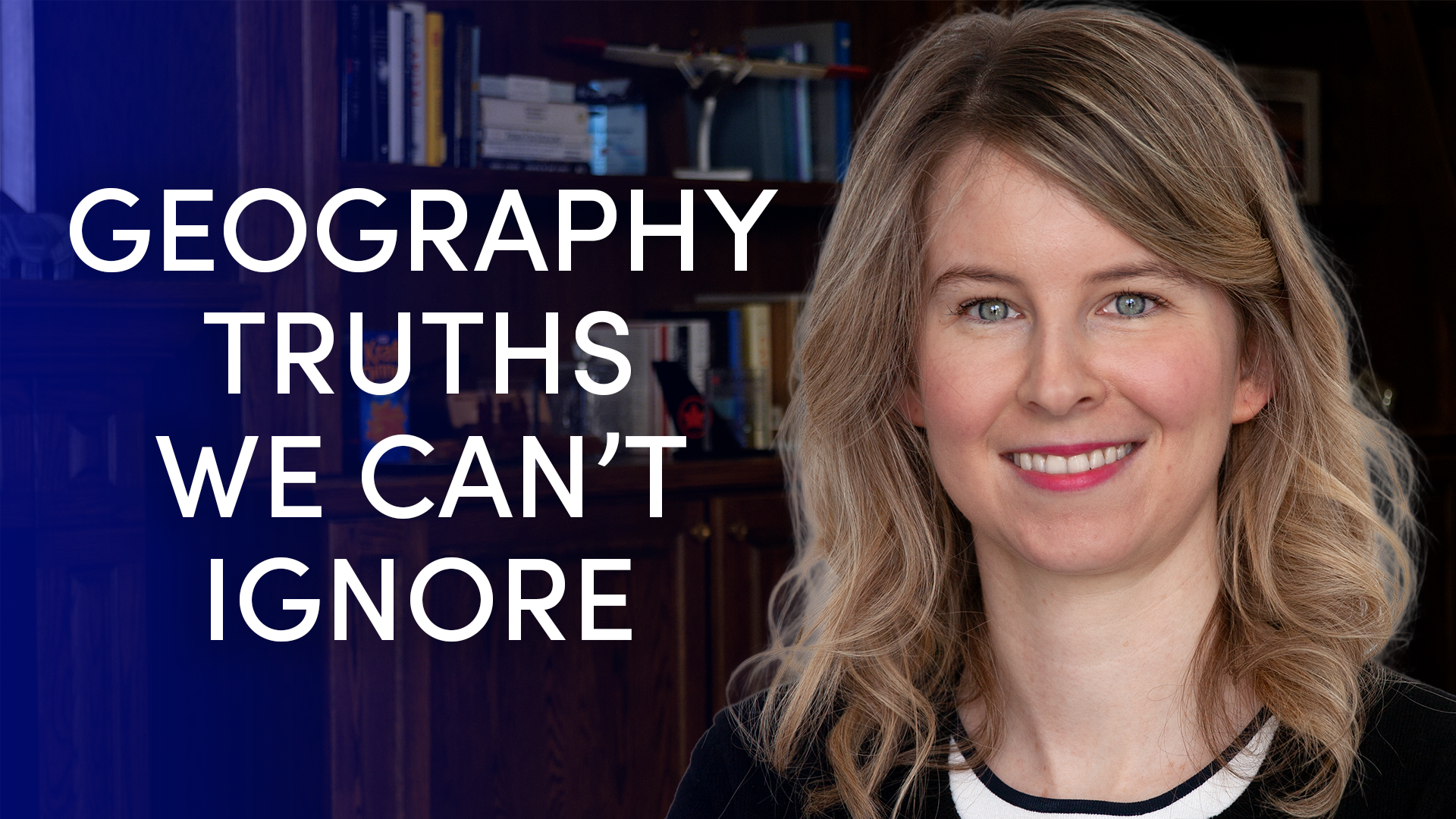

For Canada, trade diversification is easier said than done

When we talk about trade diversification, we often miss one key factor: geography.

Rise in ETFs, Fewer IPOs and Shifting Capital Flows: Trends to Watch in Canadian Public Markets

The rising number of ETFs alongside a declining number of IPOs may signal fewer listing opportunities for Canadian companies on the TSX, while also influencing the relative share of Canadian equities in retail investor portfolios. Investors following these trends may want to take a closer look at where their money is being allocated, and what that means for their domestic market.

Considerations for advisors implementing CRM 3 regulations

“Growing demand for transparency”: How advisors can use CRM3 to strengthen client relationships and build trust.