When a person has credit, that means they can obtain goods or services before payment, based on the trust that payment will be made in the future. Having good credit means that person has a history of paying bills on time and in full, including installment and revolving loans, over a long timeframe. Good credit is crucial for anyone who plans to rent or buy a home, buy or lease a car, or apply for any sort of credit card or line of credit.

A credit score is a numeric indicator of both the ability to manage credit and riskiness of a borrower, whether personal or for a business.

A credit report is a document that summarizes someone’s credit history.

Establishing credit

A credit report is created the first time someone borrows money or applies for credit. A loan history is included in the report, as well as the credit score.

Building credit

Building credit takes time — there’s no magic formula that works overnight. It requires discipline and organization to ensure bills all get paid on time and in keeping with applicable repayment terms.

Lenders send information to the credit bureaus, also known as credit reporting agencies. The two main ones in Canada are TransUnion and Equifax. They both also operate in the U.S, along with a third agency called Experian.

No credit history or a poor credit history will usually make it harder to get a credit card, loan or mortgage. The impact of any negative credit events will lessen over time and eventually disappear entirely. Bankruptcies stay on the longest, for up to 10 years.

Why credit scores are so important

The FICO credit score and credit history, as detailed in a credit report, are the most important determinants of lending decisions. The credit report is a detailed record of how someone manages their bills and any other credit they have access to.

Financial institutions review the credit report and score to determine whether or not it will be safe to lend someone money — namely that they’ll be repaid in full and on time — and how much interest to charge them.

Lenders want to reduce their risk by verifying that a prospective borrower’s credit history and finances properly align with the loan they’re applying for and its terms. Lenders try to assess what kind of borrower someone will be. Credit score and credit history tell them how someone has managed – or mismanaged – credit, in the past.

Understanding credit scores

The most widely used score in North America is the FICO 8, which is issued by the U.S.-based Fair Isaac Corporation and ranges from 300 to 850. It used to be known as the Beacon score. FICO sells its score to both Equifax and TransUnion and says 90 per cent of Canadian lenders use it, including the big six banks.

It is typically updated on a monthly basis, but sometimes more frequently than that. This table outlines the different score ranges and what each means in terms of the likelihood of approval on a new credit application.

| FICO Score Range | Lending Prospects and Possible Conditions | |

| 800 – 850 | Easy approvals | |

| Exceptional | Lowest interest rates and fees | |

| 740 – 799 | Likely to find many attractive lending options | |

| Very good | Better interest rates and terms than those scoring in the “Good” range | |

| 670 – 739 | Acceptable borrowers to many lenders | |

| Good | Broad array of loans and cards available | |

| May pay higher interest rates than those in higher scoring ranges | ||

| 580 – 669 | May not qualify for loans from traditional lenders | |

| Fair | Interest rates may be significantly higher than for borrowers with higher scores | |

| 300 – 579 | Likely to be declined for many loans and cards | |

| Poor | Large security deposits may be required to open utility accounts or rent an apartment |

Source: Financial Pipeline, using public domain information.

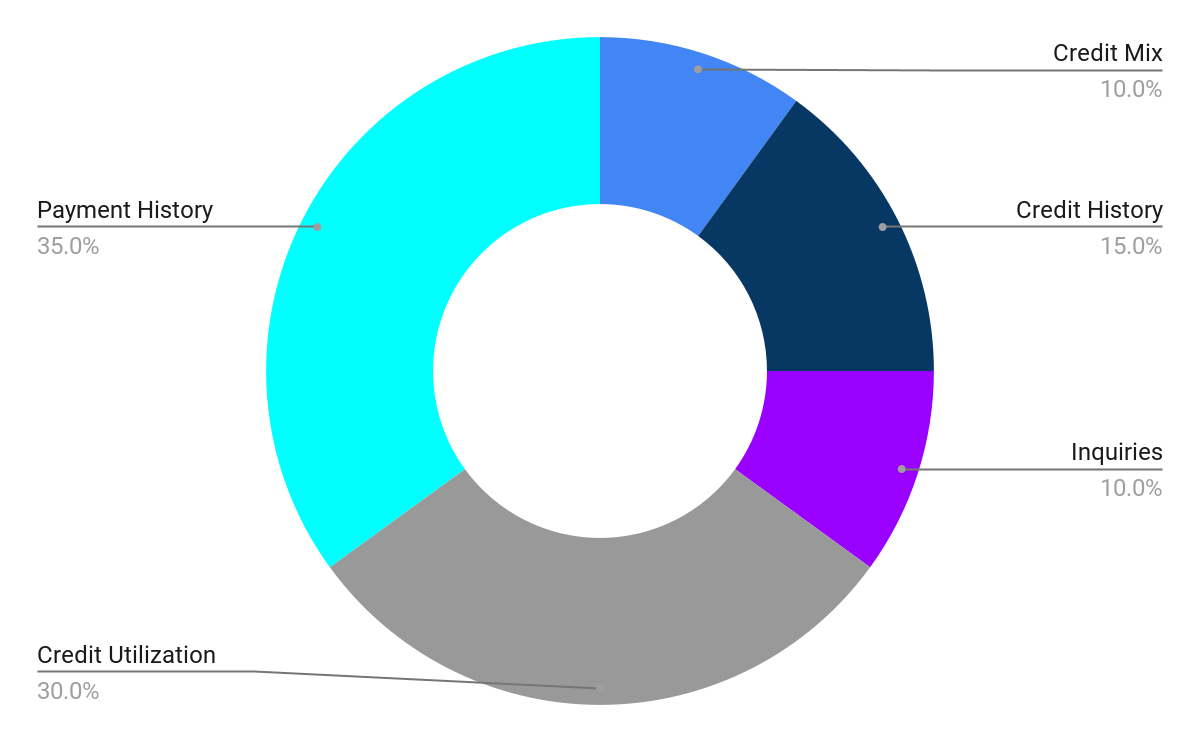

The algorithm used to calculate FICO 8 scores is not available to the public, but the factors that affect personal credit scores are known. FICO breaks them down like this:

Source: Financial Pipeline, using public domain information.

The longer the history of timely bill and loan payments, the better. Especially since this is the largest component of the FICO credit score.

One thing many people don’t realize is the different impact of credit inquiries since there are two types and they do not have the same effect on credit scores.

A hard credit inquiry occurs when someone applies for a loan and authorization is required by a lender to see if they’re eligible for approval. This will show up in their credit report and adversely affect their score. Meanwhile, a soft credit inquiry is when a lender checks someone’s credit for informational purposes, which doesn’t impact their credit score or show up on their credit report.

Accessing credit scores and checking credit reports

Americans can access their FICO score directly, while Canadian consumers cannot, which is what gave rise to the third party services that are commonplace in Canada.

There are a few ways for Canadians to check credit scores — via the credit bureaus or by using a third party service provider. Reports can be mailed, emailed or obtained online. Consult their websites to obtain a credit report or consider one of these companies for access to a free report: Credit Karma and Borrowell. Note that the credit reporting agencies usually provide reporting as part of a monitoring service that requires a paid subscription.

It’s worth pointing out that the credit scores will not necessarily be consistent across the various providers. This is because some factors can be weighted differently depending on the credit bureau or provider, resulting in different scores.

Some experts warn against focusing too heavily on the credit score, suggesting that everyone should pay closer attention to their credit report to ensure its accuracy and commit to doing so on a regular basis.

New credit approvals

Before applying for any new loans or credit, check your credit score and report, especially if you don’t do so regularly. Use the contents to make improvements prior to applying for any new credit to increase the chances of the loan application being approved. As indicated in the table above, traditional lenders usually require a score of at least 660 for a personal loan application to be approved.

Most importantly, try to limit credit applications to loans you really need and can afford, even if there were changes to your household budget, like a rent increase or job loss. This is critical to maintaining a good credit score and being able to access credit when you might need it most.