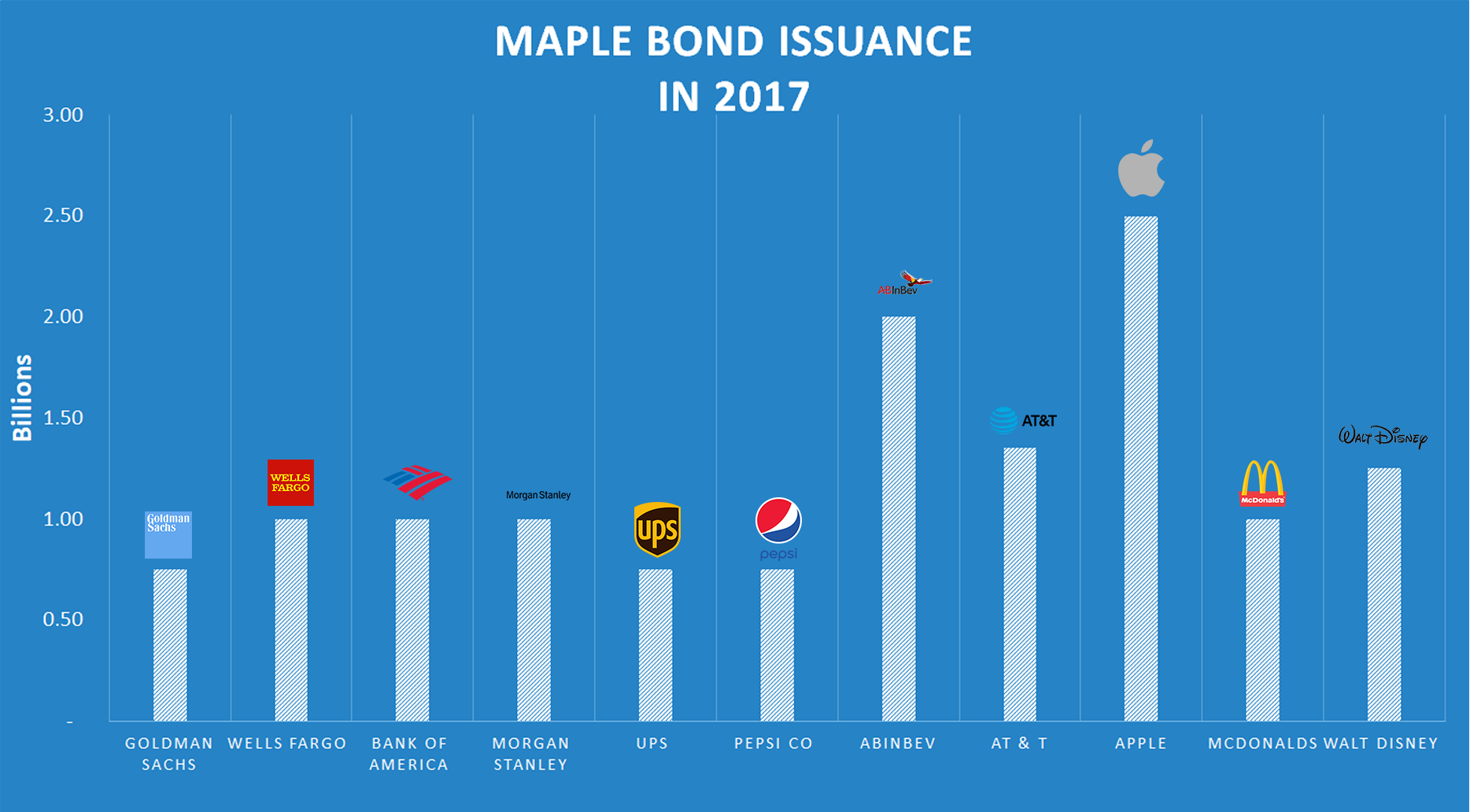

The Walt Disney Company jumped into the maple market, following other U.S. giants like Apple and McDonald’s in what is shaping up to be one of the busiest years for foreign-issued bonds.

The company had initially aimed to raise C$750 million of senior unsecured notes but sold C$1.25 billion worth of bonds maturing October 7, 2024, priced at 81 basis points over the CAN 2.5% the Government of Canada benchmark bond.

It’s Disney’s first issue in Canada, and one that suggests outside interest in the Canadian bond market shows no signs of slowing down.

“They were looking to diversify their investor base; this is their inaugural transaction outside of the U.S.,” said Bradley Meiers, managing director and head of debt capital markets at HSBC Securities Canada, the bank that led the issue.

“As you can imagine, I think they were excited and little bit nervous but it worked out well. I think they’re very, very pleased with the reaction. We got pricing that we believe for them is very competitive and at the same time is compelling for Canadian investors as well.”

The deal brings diversification to Canadian investors, who wouldn’t normally have access to this type of bonds, and who’ve been facing lower domestic issuance over the past year.

The maple boom is also due in part to interest rate differentials between the U.S. and Canada, which are making the pricing attractive to outside issuers.

U.S. companies with operations in Canada will often keep some of the Canadian dollars they raise to fund local operations, but often times, the money gets converted back to U.S. dollars through currency swaps.

In Disney’s case, the company said it planned to use the proceeds of the issue for general corporate purposes.

In addition to McDonald’s and Apple, PepsiCo Inc., Anheuser-Busch InBev SA, United Parcel Service Inc. and AT&T Inc. all issued Canadian-dollar denominated bonds.

“The one thing about most of these issuers is that they may not know Canada that well, but their companies know Canada well in the sense that they do business with Canada on a regular basis, so it’s a very comfortable market for them to issue into,” said Meiers.

Interest in the maple market is likely to remain strong, he added, as long as banks and dealers keep focusing on diversification and on companies that investors know well.

“The one thing that I would say about our industry in general, not just Canada but worldwide, is that you see a trend and you hop on and you go with it,” said Meiers.

“We need to watch this carefully and make sure that we don’t saturate the market with the same type of issuers and the same type of products. This is a diversifier for investors and if we forget that and keep bringing things that aren’t true diversifiers, then I think that would not be good for the maple market in general.”