Pricing, demand and a solid market can boost interest in the maple market, as it did in 2017

A combination of attractive prices and increased demand in a sophisticated marketplace can boost issuance in the maple market, Canada’s go-to arena for foreign companies and banks.

After a prolonged slump since the 2007-2008 credit crisis, the market for foreign-issued bonds found its footing in the first half of 2017 and reported some its healthiest months in years.

It was also a time when Canadian banks and corporations were a little less active in the domestic market than the market had been expecting – a move that coincided with certain maturities and coupon payments coming due.

“With that lower domestic issuance, cash balances were beginning to build up, and as a result the maple issuers were able to step in and fill that void,” said Bradley Meiers, managing director and head of debt capital markets at HSBC Securities Canada.

And since, unlike the Federal Reserve in the U.S., the Bank of Canada kept interest rates low for a long period of time, the pricing actually “really started to work for international borrowers,” he added.

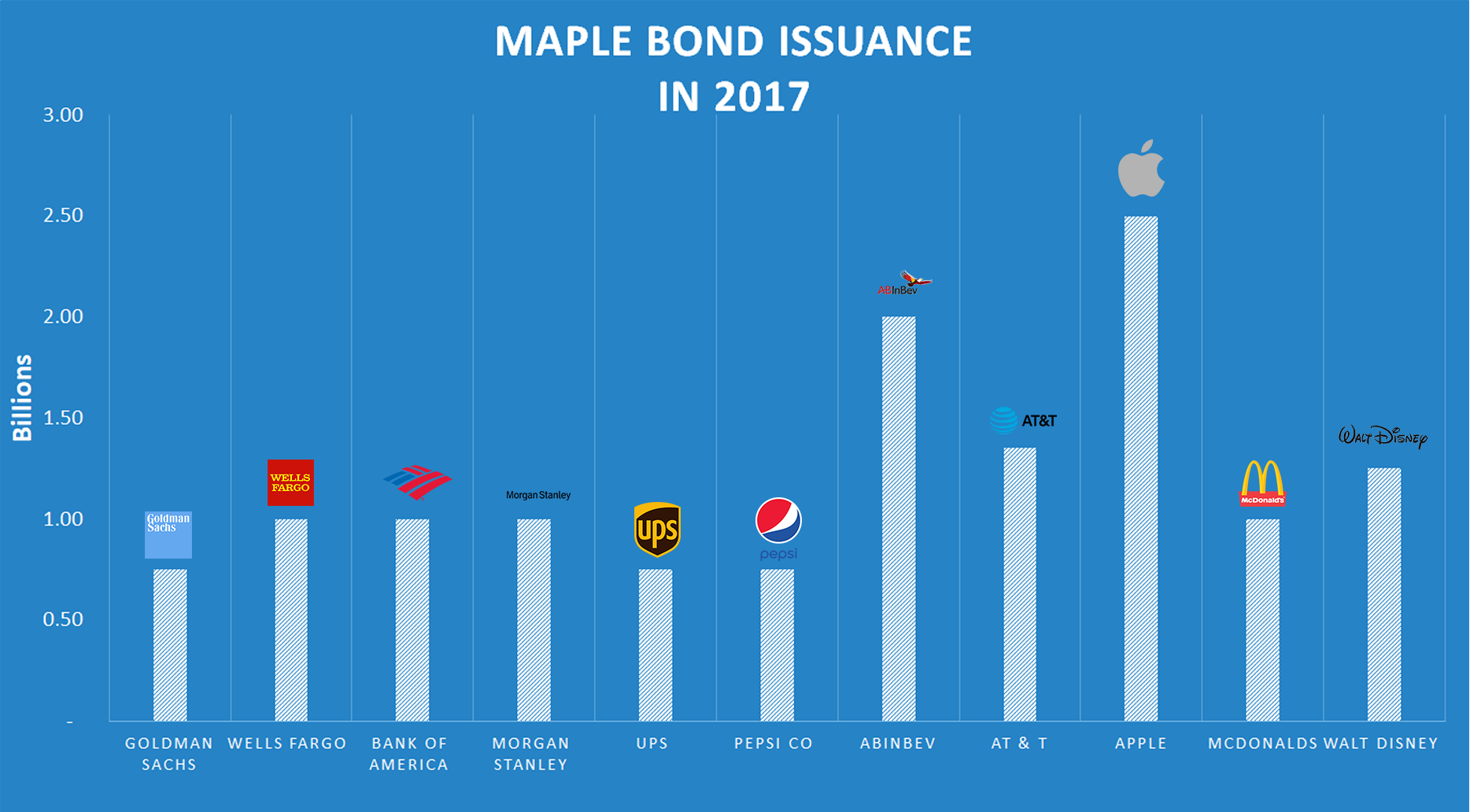

As a result, Canada began to see maple bonds issued by the likes of Pepsi, UPS and AT&T – companies that provided great opportunities for investors to diversify.

“When you can truly offer diversification away from other industries or sectors that the Canadian market is light on, then there’s a real peak of interest,” Meiers said.

Maple bond offerings provide Canadian investors the opportunity to hold fixed-income securities they normally wouldn’t have access to, and to buy them in Canadian dollars. Banks that take the lead on these issues usually look for recognizable names that institutional investors would like to see in their portfolio.

For issuers, tapping into foreign markets can create a great chance to diversify their investor base, as long as the market is one they’re comfortable operating in and the pricing works.

“To the degree that the pricing works for them, (Canada) actually is an attractive market because it’s relatively deep and there’s sophisticated, investment-grade investors,” said Meiers.

The maple market is expected to continue to grow as long as the pricing works and the demand continues to be there – although likely not at the record-breaking levels of the first half of 2017.

“These maple bonds are not currently in the main part of the index that everybody gets measured against, you can’t have too big a percentage of your portfolio in products that are outside the main index,” Meiers said.

“When the market is rallying and spreads are tightening and rates are falling and you’re making money, to have products that are outside of the index is usually beneficial to your portfolio as an investor.

But the opposite is true – when spreads start to widen or rates back up and you’ve got those bets outside of the main index you will under-perform, so in this situation you don’t want to have too much of that outside of the index.”