We talk about risk a lot when it comes to investments because risk is an integral part of investing, and the “right” type of risk can lead to some lofty rewards. But, risk perception and loss aversion are highly personal and often emotional concepts, and any investor wishing to strike the right balance between the two needs to understand the intricacies of the risk-reward trade-off.

Risk aversion refers to the fact that people will only consider risky investments if they provide enough compensation for that risk via a premium or payout — over and above what they could expect to receive on less risky investments. It’s uncompensated risk that investors want to avoid; but, if they have a reasonable chance of being rewarded to take on extra risk, many will take that trade-off.

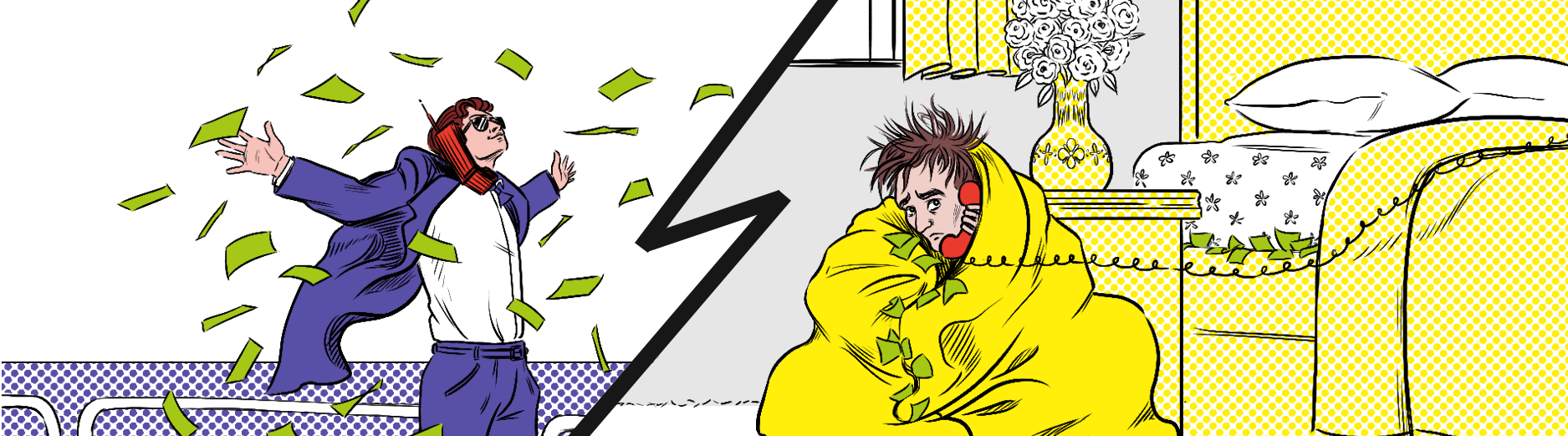

Loss aversion is the concept that investment gains contribute less to happiness than equal losses detract from happiness. In other words, the pain of losing is more powerful than the pleasure of gaining. And that pain or fear can cause investors to make decisions that adversely affect their portfolios.

What is investment risk?

Investment risk is the probability of losses relative to the expected return on an investment.

Since the effects of lower-than-expected returns are obviously more problematic than higher-than-expected returns, “risk” in everyday language really only refers to the chance of lower returns or losses. No one worries about investments that exceed their return expectations.

Risk and return

The relationship between risk and return is at the heart of investing. The idea is that investors willing to hold risky investments and potentially lose more money should be more handsomely rewarded for taking on that risk. The greater the amount of risk an investor is willing to take, the greater their potential return.

The level of risk associated with a particular investment or asset class typically correlates strongly with the level of return the investment might achieve. At the asset class level, stocks are riskier than corporate bonds, and corporate bonds are riskier than government bonds or savings products. Investors’ asset mixes are driven largely by their risk tolerance, as well as time horizon and investment objectives. Every investor will have to find their own balance between the desire for the lowest possible risk and the highest possible returns.

Higher risk doesn’t guarantee higher reward

It’s also important to keep in mind that higher-risk investments won’t automatically produce higher returns. The risk-return trade-off merely indicates that higher-risk investments have the possibility of higher returns — but there are no guarantees. For some, investing is all about saving for the long term and doing so in a very slow and deliberate manner. For others, short-term gains might be what’s most important. Ultimately, it comes down to individual priorities and personal objectives.

Perceptions of risk

Risk perception is the way investors view and assess the riskiness of financial assets, based on their own personal concerns and experiences. What constitutes risk can differ markedly from one person to the next, and will often change over time.

Each investor has to decide how much risk they’re willing and able to accept for a desired return. This will be based on factors such as age, income, investment goals, cash flow needs, time horizon, and personal preferences.

The risk of loss is always there if you invest in anything other than cash or GICs (Guaranteed Investment Certificates). But it’s unlikely to matter as much to someone who has decades until they retire than to a new retiree who no longer has any employment income.

Risk management

According to Carl Richards, Certified Financial Planner™ and creator of the Sketch Guy column, “risk is what’s left over after you think you’ve thought of everything.”

The most basic — and effective — strategy for minimizing risk is diversification. Diversification means not putting all your eggs in one basket by having investments in different asset classes, styles, countries and market capitalizations. This helps mitigate risk as investments will be affected differently by the many factors that can influence asset prices.

But, diversification cannot fully protect investors against losses. Risk management must be an ongoing exercise. It requires regular assessments of your situation and portfolio rebalancing — back to existing targets or to newly-established ones, if something has changed.

Finding the right balance between risk and return will go a long way towards helping investors achieve their financial goals through investments that they are comfortable owning — even during down markets. FOMO is real and it’s easy to get distracted by all of the #FinTok stories of huge overnight gains, blockbuster IPOs, and cryptocurrency billionaires, but the risk of not meeting your long-term goals has to be the greater concern.

Research has repeatedly shown that loss aversion can meaningfully influence financial decisions. Unfortunately, the influence it wields can cause investors to mismanage their portfolios. The key is to focus on risk aversion, but only consider material risks and ignore the day-to-day noise of the markets. That’s why having a plan and sticking to it are so important to long-term investment success.