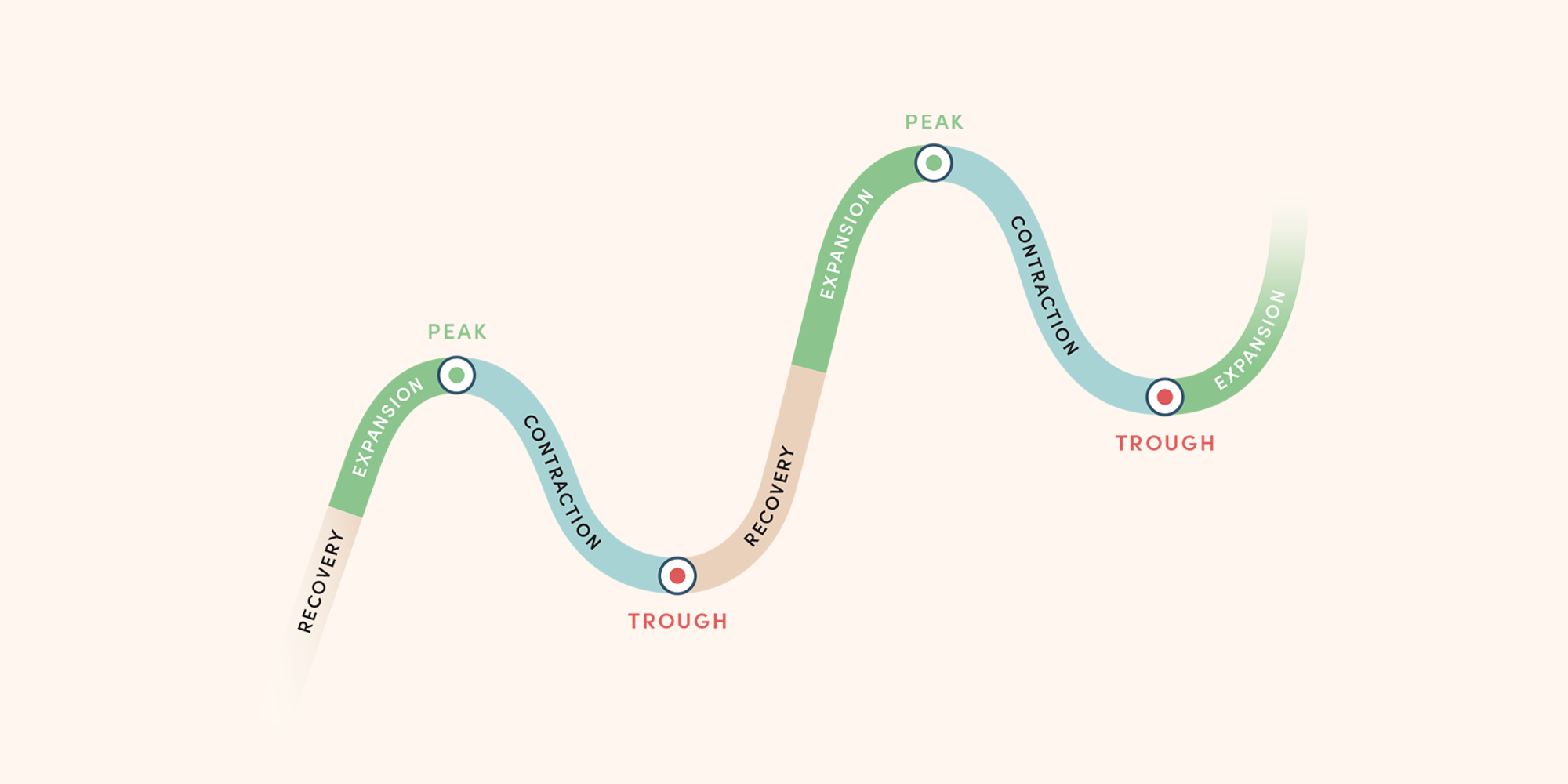

The business cycle is the ebb and flow of economic activity and consists of four distinct phases: expansion, peak, contraction, and trough. History has shown that certain sectors have tended to fare better or worse during a specific phase, while others are largely unaffected as the economy moves through its various phases.

The 11 GICS sectors are Communication Services, Consumer Discretionary, Consumer Staples, Energy, Financials, Healthcare, Industrials, Information Technology, Materials, Real Estate, and Utilities. This classification scheme was created in 1999, but many of the sector labels have been used for decades.

While some sectors perform differently during the four phases of the business cycle and it’s useful to know when various sectors might perform better or worse, we do not recommend market timing by sector. Investors should maintain exposure to the various sectors in their portfolio in order to benefit from diversification, which is the best way to protect themselves from the inevitable volatility of the markets and the tendency to make unfounded investment decisions.

Economic growth and the business cycle

Although it’s a single phase, it’s useful to separate an expansion into two parts, with the initial portion of an expansion labelled a recovery and the remainder referred to simply as an expansion.

During a recovery, the economy rebounds from a bottom or trough. GDP growth and demand rise as consumers become more optimistic about economic growth prospects and increase their discretionary spending, while businesses resume commercial activities they cut back on during the contraction and trough phases.

Improving economic prospects and burgeoning corporate profits lead companies to allocate capital to expansion and enhancing productivity, which are needed in order to meet increasing demand. This continues until growth reaches a peak.

Following the business cycle peak a slowdown occurs because an economy cannot continue to expand beyond its full capacity. Growth can still be positive, but the rate of growth slows during the contraction phase.

Slowdowns don’t always lead to recession, but the economy must bottom before the next recovery can begin. Economic growth falls precipitously, with declining production and demand from consumers and businesses. Rising unemployment and low consumer confidence compound cuts to discretionary spending and commercial activity similarly drops.

Sectors and phases

Recovery

The economy quickly gains momentum after reaching a trough and improving labour market conditions reduce unemployment and lift consumer confidence, which lead to increases in discretionary spending and benefit the Consumer Discretionary sector.

Credit markets begin to grow again as monetary policy continues to ease and falling interest rates supply money and liquidity to a weakened economy, which boosts the Financials sector.

Lower interest rates via easing monetary policy make real estate more affordable while increased business activity lifts the value of commercial real estate, enabling outperformance by the Real Estate sector.

During this stage, when growth rates are the highest, economically-sensitive sectors like Information Technology, Industrials and Consumer Discretionary will usually be the ones to outperform.

Expansion

A typical expansion will benefit more sectors than any other business cycle phase, as economic growth accelerates and corporate earnings grow. Rarely do we see one or two sectors dominate during this phase while non-cyclical or defensive sectors remain out of favour.

Consumers and businesses become increasingly confident about growth prospects, which prompts consumers to loosen their purse strings and benefits the Consumer Discretionary sector.

Businesses start allocating capital or allocate larger amounts of capital in order to expand and heighten their productivity, which tends to benefit the Information Technology sector.

Business expansion and more consumers buying big ticket items will increase loan volumes. This along with usually minor interest rate increases during this phase, typically benefits the Financials sector.

Meanwhile, defensive sectors — Consumer Staples, Utilities and Healthcare — are less appealing as the economy regains strength and investors increasingly turn to growth-oriented sectors in order to benefit from the upturn in the economy and equity markets.

Contraction

A slowdown follows the higher growth mid-cycle period and upon entering this latter part of the cycle more defensive and inflation-protected sectors tend to outperform.

Investors will position their investments more defensively and reduce allocations to more economically-sensitive sectors. This is because those sectors tend to be the first to experience cuts once income and business activity start to drop.

Materials, Consumer Staples, Utilities, Energy and Healthcare benefit as demand for goods and services in these sectors is less sensitive to economic fluctuations and relatively unaffected by where we are in a business cycle.

Real Estate and Information Technology will usually fare the worst based on being heavily skewed towards the discretionary end of the spending spectrum. And, spending on wants will recede in a downturn, so Consumer Discretionary will suffer too.

Trough

Economic activity and corporate profits reach their nadir. The stock market may have entered a major correction or even a bear market by this point. Interest rates are at peak levels. The best sectors in this phase include the same sectors that began to gain favour in the late-cycle phase.

As the contraction phase winds down towards a trough there aren’t usually any sectors that actually do well as stocks perform poorly most of the time. During a recession investors look to companies that provide stability and are more defensive. These include Consumer Staples companies that provide goods and services people need regardless of economic conditions.

Another example of this is Healthcare, because people always need medical services and pharmaceuticals. In addition, Utilities and Energy can outperform during this phase as these are non-negotiable for people who need and use them.

History not repeating itself

Materials and Energy have historically performed well in many slowdowns, but these markets have become more integrated with the global market, so much so that a boom in commodity prices during U.S. economic slowdowns is occurring less frequently of late. Since the 80s there is little to no clear pattern of outperformance or underperformance during any particular phase of the business cycle for Energy and Materials.

A guide, but not for certain

History shows some interrelationships between how certain GICS sectors perform during the different phases of the business cycle and are influenced by economic growth prospects and the monetary policy decisions needed to manage the ebb and flow of activity during a full cycle. But, as with any market observations, they are just that – and not rules. It’s also important to note that the length of an overall cycle and its phases can vary quite considerably.