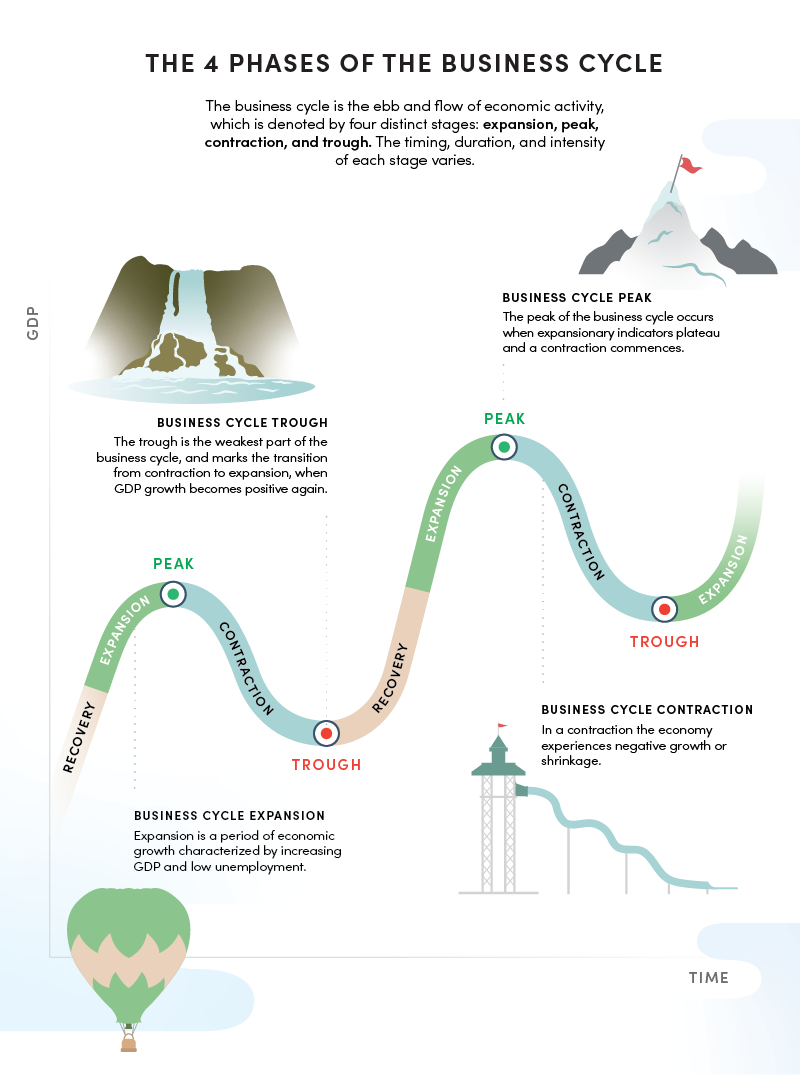

The 4 Phases of the Business Cycle

While we know that it is not possible to ‘time the market’ to increase returns, the economy does move in cycles that include periods of economic expansion which are then followed by periods of economic contraction, which in turn affect the value of investments, as well as employment levels.

The expansion or growth is measured using the increase or decrease of real GDP (Gross Domestic Product), which is GDP adjusted for inflation.

Business Cycle Expansion

Expansion is a period of significant economic growth and business activity, causing GDP to expand.

Consumers typically have money to spend, which in turn increases demand for products. To meet this increased demand and to gain corporate profits, businesses increase inventory levels. As a result of these profits, the stock market is strong, markets typically rise, and new business start ups outnumber business bankruptcies.

Business Cycle Peak

The peak of the business cycle occurs when expansionary indicators plateau and a contraction commences.

GDP growth dips below 2% and continues to decline.

At this point in the business cycle, the demand begins to be greater than supply, thus pushing up prices. Labour and product shortage cause wage and price increases, which increase inflation and decrease overall consumer purchasing power.

When consumption reduces, business sales and profits decline, which are reflected in lower stock prices and overall market activity declines. Interest rates rise, bond prices fall, and inflation increases.

Business Cycle Contraction

Contraction in the business cycle refers to a decline in economic activity (negative GDP).

During a contraction, economic activity declines and real GDP falls. If this continues for two consecutive quarters, the economy is said to be in a recession.

As the economy falls, businesses are left with unsold inventories and declining profits. They react by reducing production, deferring investments, and may lay off employees, which in turn reduces overall household income. Consumers react by deferring purchases, opting to increase their savings, which further cuts into business sales and stock market prices and activity.

Business Cycle Trough

The trough is the weakest part of the business cycle, and its lowest.

This is characterized by falling inflation and falling interest rates, triggering a bond rally. Consumers who had previously chosen to save rather than spend are encouraged to spend, as the interest rates are now lower. With increased spending and financing, businesses start generating more revenue and stock prices rally to reflect this new economic activity.

Recovery

During recovery, GDP returns to its previous peak as consumers once again start buying items that are sensitive to interest rates, such as housing and automobiles. Businesses that had reduced inventories start production again to meet this new demand and may begin hiring again, though they are still hesitant to make significant new investments.