Bonds are having a rough go thus far in 2022. The U.S. bond market is down nearly 9% from its August 2020 peak, marking the longest and deepest correction in bonds in recent history. This is unfamiliar territory for fixed income investors, who, until recently, have mostly only seen their bonds and bond funds going up in value.

That’s been the case for the last 40 years – until the past 18 months, when bond performance turned red.

When things work…and then they don’t

The recent volatility in Government of Canada (and US Treasury) bonds highlights a fundamental bond market risk that has produced more reward than pain for bond investors over the past four decades – duration. Simply put, duration is a measure of bond price sensitivity to changes in the level of interest rates – which is important, since the relationship between bond prices and interest rates is an inverse one.

Given prevailing conditions, this is likely a good time to go with active over passive strategies, unless you’re comfortable with quite a bit of duration risk.

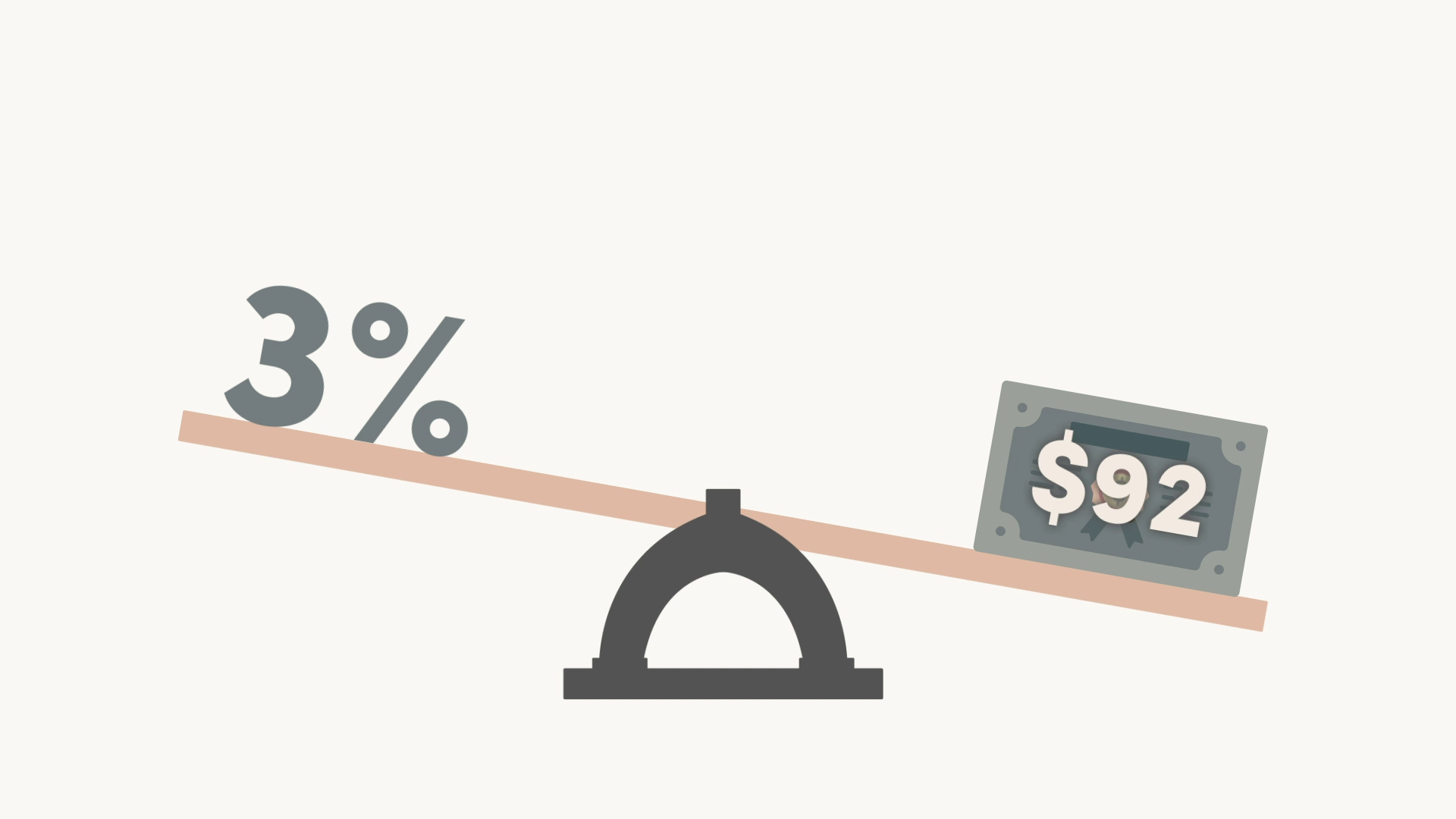

Nominal vs. real returns

Nominal or top-line returns are what’s earned before inflation, while real returns are what’s left after inflation. This distinction has become more important as inflation is now higher than it’s been for a long time.

Fixed income investors currently get fixed coupon payments at rates well below headline inflation. Skinny coupons provide little protection against a decline in bond prices. Essentially, the coupon interest gets wiped out by price declines, as interest rates rise. This is precisely what’s happened recently. Meanwhile, in previous eras, higher coupon rates protected against price losses. This is contributing to the somewhat grim outlook for bonds at the moment.

Paper vs. real losses

In the midst of so much uncertainty, selling might help you sleep at night, but it could adversely affect your portfolio’s long-term performance. Knee-jerk reactions seldom produce good investment outcomes. Besides, once you decide to exit, you have to figure out when to do so, where to put the money, and when to get back in. This is extremely difficult to figure out – and to get right. Having a long-term plan is important because it will help you navigate periods of market turbulence.

A paper loss only becomes a real one when you sell. If investors are focused on the long term, they have to expect downturns along the way. You cannot achieve investment gains without assuming risk…and bigger gains come from taking on more risk, which means those downturns will be bigger too.

Bonds vs. bond funds

Direct ownership of a bond is different from owning a bond fund. With direct ownership, you hold the bond, collect coupon interest and receive the face value at maturity. You don’t need to worry about what the bond is worth to anyone else – that price is only important if you intend to sell.

With a bond fund, the portfolio managers and other investors are at the mercy of unitholders who panic sell or need money from their accounts. This is where it gets tricky, since managers are obligated to generate cash for unitholders. This might force them to sell at a disadvantageous price that they wouldn’t have otherwise accepted.

Inflation is bad for bonds

Against a backdrop of high inflation and ahead of what could be several rate hikes, the outlook for the Canadian and U.S. bond markets is pretty bleak. Bonds today offer very little expected return, while exposing investors to high levels of risk.

That being said, “a bad year for government bonds is a bad week for stocks,” as Barry Ritholtz said in a recent interview with Bloomberg. He reminds us that having some fixed income is a good offset to equity market volatility. He also points out that a 5% drawdown is very rare for a portfolio of U.S. Treasury bonds – last happened in 1994 and it was very brief.

Don’t panic

These days, it seems there’s a website or an app for everything, including investment companies. But, do investors need 24/7 access to their accounts? Should we check balances daily or even multiple times a day? This is especially problematic when it leads to panic selling. It’s too easy to hit the sell button when headlines are screaming doom and gloom.

Some wealth management professionals say you should check quarterly while others say monthly is fine. The key is to decide on the frequency that works for you – and stick to it. Use these check-ins as an opportunity to review your investment statements and rebalance back to your portfolio targets, which is the surest way to buy low and sell high.