For Canadian companies looking to raise money, tapping into foreign markets is a great way to diversify their investor pool rather than relying solely on a relatively narrow Canadian investor base.

By issuing in the U.S. or other foreign markets, a Canadian company or institution can have access to a new set of investors, allowing it to diversify the number of institutions who hold its debt.

It’s also a way for the company to get its foot into a new market. As an outsider, the firm may not be well known in the country it wants to raise capital. That means choosing to buy into its offering is a lot more work for local investors – they’d have to do due diligence on the company, its credit rating and its prospects.

But once the company has issued in that market, it’s easier to go back.

The province of Ontario, for instance, may do a debt issuance in Europe because it wants to tap into investor demand around the world to broaden its base.

“Once investors have done their credit work, are confident in the credit-worthiness of the issuer and the liquidity of the bonds they are buying, it makes it easier to tap those investors regularly,” said Rob White, chief executive of Outcome Wealth Management.

For investors in Europe, that kind of deal gives them a bond to invest in that’s backed by taxpayers and therefore unlikely to default – if a province gets in trouble, it can always raise taxes.

Compared to a similarly rated German bond, for instance, a province of Ontario bond will give European investors diversification. They may be able to buy that bond a few basis points cheaper as well.

“You’re looking at economics, raising funds as efficiently as possible, you’re looking at paying back your bankers, you’re looking at where the mix of assets and liabilities are, and you want as many investors as possible,” said White

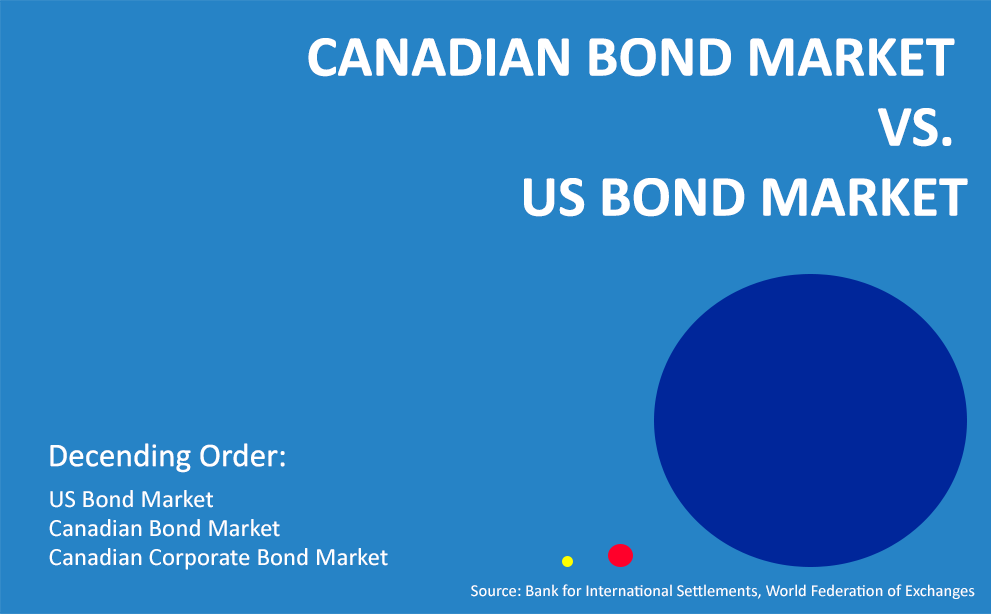

For companies looking to issue in the U.S., another benefit is that the American bond market is bigger and more liquid than its Canadian counterpart.

It’s also made up of more aggressive investors, who may be willing to take a risk on an issue that Canadians, who are typically more risk averse may not.

According to Bill Girard, vice-president and portfolio manager with 1832 Asset Management, issuing abroad will also free up appetite for future domestic offerings.

“You always want to be able to issue in your home market, so if you satisfy all the demand in your own market, then you can be forced to go to another one,” said Girard.

“You’d rather do that opportunistically.”