A mortgage broker can help you find the best option, but it’s a good idea to do a bit of your own research before you start.

Finding the right mortgage can be a daunting task, especially for first-time homebuyers who know little about the terms or rate options involved.

But anyone who’d like some help untangling all of the alternatives has the option of recruiting a mortgage broker to lead the search.

“The bottom line is that a mortgage broker can do the legwork and do the running around and the comparison between the various lenders, and that may be time-consuming for the home owners to do themselves,” said John Andrew, a real estate expert with Queen’s University who also leads that school’s Executive Seminars on Corporate and Investment Real Estate.

“The choices are rather overwhelming, because you get to choose your term, you get to choose whether or not it’s fixed or variable and all of those things, so there’s a certain advice component that the broker can provide as well.”

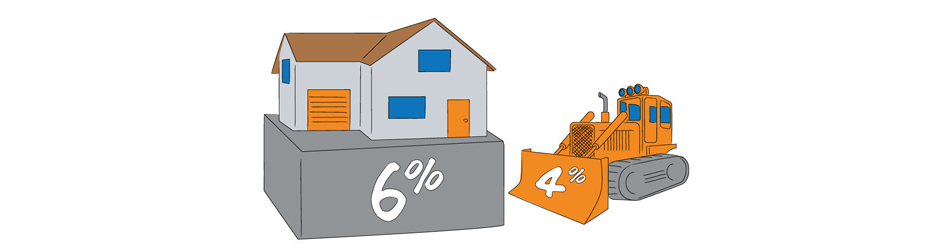

In addition to legwork and advice, using a mortgage broker can provide you with a bit of a competitive advantage.

If the broker has solid relationships with certain lenders, they may provide preferential rates.

You may also end up with a more competitive rate if your broker is dealing with a few lenders who know they’re all bidding for the same business.

It’s important to keep in mind, however, that brokers don’t bill you for their services – they get a commission from the lender for bringing in your business.

That commission will vary from one lender to the next, so the advice you get about which mortgage to go with may not always be as impartial as you think, Andrew said.

“Consumers need to be aware that the broker is to some extent working for you, but you’re not paying them,” he said.

“(They) can’t be under the illusion that they’re getting independent advice (because) they’re not.”

Of course, the fact that brokers get a commission doesn’t mean they will act unethically.

But the question about how they get compensated by one lender versus another is one you need to ask.

It’s also a good idea to make sure you’re dealing with someone who has the proper accreditation and who is listed on a guide such as the Financial Services Commission of Ontario’s online directory of licensed mortgage professionals or the Canadian Association of Accredited Mortgage Professionals.

You can also do some of your own legwork before meeting with a broker, by comparing rates on sites like RateSupermarket.ca or RateHub.ca, which list the posted rates from various banks and lenders.

That way, you’ll at least have a general sense of what’s currently offered by the major institutions and a baseline to compare your broker’s proposal to.

But keep in mind that as important as rates can be, the terms and conditions attached to any mortgage may matter even more.

The fact that you’re allowed to make lump sum payments, for instance, will help you pay the loan off much faster since all that money would go straight to the principal amount you owe and not to interest.

When you compare the relative value of the mortgages your broker offers you, those are also questions you want to raise, Andrew said.

“The type of mortgage that you get, not just the rate options that you choose, has enormous bearing on what that total cost is.”