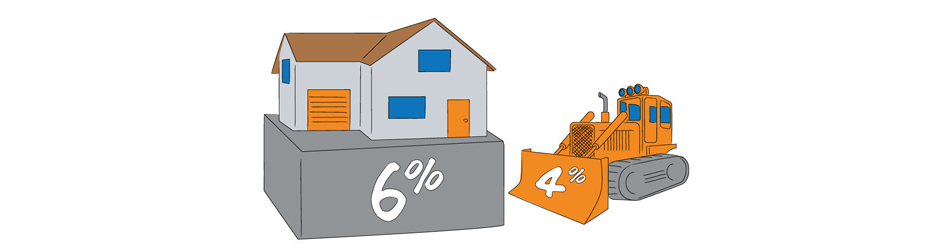

In times of low interest rates, refinancing your mortgage may be a smart move. But while a new mortgage can have its benefits, you should keep your overall goals in mind.

When interest rates are low, it may be tempting to refinance your mortgage save on your monthly payments.

But while refinancing may give you a lower rate, it’s important to take your overall situation – and the actual terms of the loan agreement – into account before you agree to anything new.

“People need to do some homework behind it,” said Dilys Harrison, VP of Community Banking at Meridian. “As much as rates are important, it’s not all about rates.”

Your motivation may simply be to lower your payments, she said, but you could be looking to refinance so you can tap into equity and pay down debt.

Perhaps you are renovating and want increased cash flow, or you want to roll other lines of credit into this new mortgage to consolidate all your debt at a lower interest rate. You could also refinance to reduce the overall amortization period so you can pay the mortgage off faster.

Like with any other big financial decision, it’s important to think about your overall goals and talk to a financial advisor who can help you figure out what you need to stay on track.

“It’s understanding what your objectives are and what you want to get out of it,” said Harrison.

A lower rate may be not be worthwhile, for instance, if it means you lose the option to skip a payment or to extend your amortization if you lose your job.

You need to carefully read the loan agreement and ask questions to make sure the terms attached to the lower rate are reasonable, and that you aren’t over-extending yourself.

As part of your mortgage, many institutions will also offer you a home equity line of credit, which allows to borrow against the equity in your home.

“Home equity lines of credit are a great way to tap into your equity, but it can also keep you in perpetual debt,” said Harrison.

“You constantly can tap into those funds, (so) you can find yourself never paying your mortgage off. Because it continually provides you with the ability to access credit, you actually have to be quite disciplined on that.”

There could be situations, however, when refinancing your mortgage isn’t a good idea, no matter how low the rates.

If you’re locked in to an existing mortgage, the penalties for breaching that contract can be quite high.

Typically, you will pay three months’ interest on a closed, variable rate mortgage. However, if you have a closed, locked-in mortgage, you will likely pay either the three months’ interest or what is called the interest rate differential – whichever is greater. It is vital you find out the cost of both.

You may also be starting a new job or going through a divorce, which could impact your financial situation and make you less attractive to prospective lenders.

“When you go to refinance, you’re going through the whole credit-check process again, so if you’re going through a job change or something’s changed and your income has dropped, you might not qualify,” said Harrison.

“Sometimes it’s just good to sit tight and say, based on the cost – either penalty or the actual savings or (your) situation … because it’s a nominal difference.”