What Are Rate Reset Preferred Shares?

Rate reset preferred shares have proved very popular with investors, making up around 60 per cent of the Canadian preferred shares market. This type of security “resets” every five years, giving investors the choice to lock in at current rates or to opt for a floating rate coupon.

The “fixed” option would usually give you a rate based on the five-year government of Canada rates plus a set premium, while the “floating” rate coupon or interest payment resets every three months at the 3-month T-bill rate plus your credit spread.

Rate reset preferreds are meant to provide a predictable source of income, since every five years you could be sure that you’re getting a dividend that’s pretty comparable to market rates.

Unlike regular perpetual preferred shares, which lock you into a rate you can’t know will continue to be advantageous, rate reset preferred shares promise to give you a fresh start every five years, when they reset at or around the market rate.

How Rate Reset Preferred Shares Work

The dividend income on rate reset preferred shares gets better tax treatment compared to bond interest income, especially for individual retail investors. The security is perpetual, but investors collect dividends along the way, which can also be claimed under the Dividend Tax Credit, providing a good source of tax-efficient treatment as a whole.

At the end of each five-year period, the issuer can also call the stock, which means they’ll pay you back your par value for those shares.

If the shares were issued at $25, and you bought one share at $25, at the end of the period the issuer can choose to pay you your $25 back and wipe out the issue.

Issuers may do this, if, for instance, market conditions improved and they think they can reissue at a lower rate. It would be cheaper for them to redeem the outstanding shares, pay you your money back, and have a new issue.

If you’re holding floating rate resets, however, you have no certainty as to when they may be called.

If these were also issued at $25 per share, however, they’d be called at $25.50, giving the investor a little bit more and also providing the issuer with some protection. If the rate was floating and it rose very quickly, becoming very expensive for them to pay, they would have an out.

Types of Rate Reset Preferred Shares

Various iterations of rate reset preferred shares can exist within the broader fixed rate reset category, but, if you decide that you want to go floating at the end of the initial five-year period, a new security is created and the collection of all those new floating rate securities is what makes up what we refer to as floating rate resets.

Market Conditions

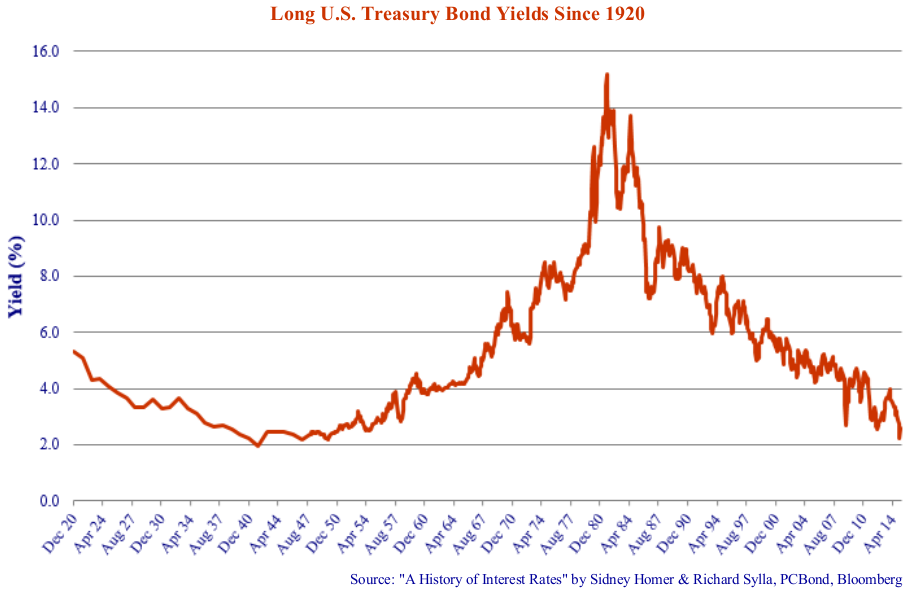

Rate reset preferred shares, which first appeared in 2008, were hit hard in 2015, dropping in value after the Bank of Canada chopped its key interest rate twice during the year. That’s because the dividend you get is determined largely by the underlying interest rates, so if the interest rates are falling you’re going to get lower dividend payments out of rate reset preferreds.

While you can’t cash in, or redeem, these shares in because they are perpetual, you can sell them of your own accord, which is what some people chose to do when the market dropped.

The rate reset market has improved a bit since, but the asset class still has a significant way to go to regain its former value in many investors’ eyes.