Distributions are taxed when received outside of tax-sheltered accounts like RRSPs, RRIFs and TFSAs. The tax effect is the same for non-tax-sheltered holdings whether these are received in cash or reinvested.

The majority of mutual funds are set up as mutual fund trusts, which are tax flow-through vehicles that allow for the distribution of all earnings to investors.

There are also mutual fund corporations, but only Canadian dividends and capital gains can be passed on to investors, as interest and foreign income are subject to taxation inside the corporate structure.

During the year, as interest, dividends and capital gains are accumulated, the fund price will increase. All flow-through vehicles must distribute any realized net income to unitholders each year.

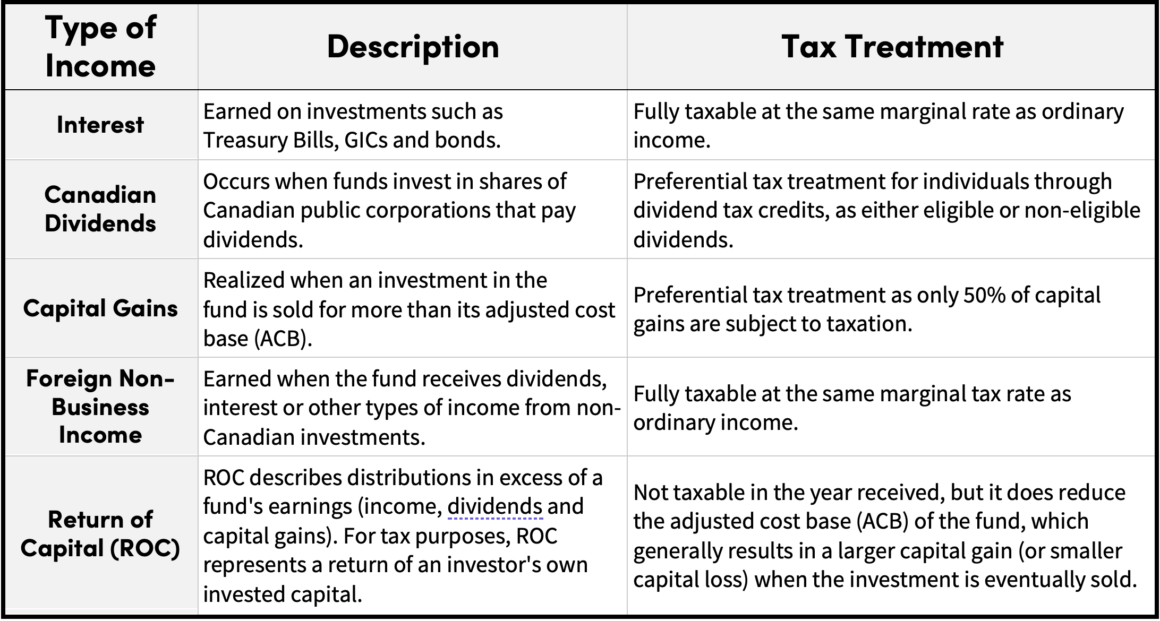

Income types

Mutual funds earn interest income, Canadian dividend income and foreign income from the securities they hold, and they generate capital gains and losses from the sale of those securities.

Return of capital explained

Return of capital (ROC) distributions tend to occur with funds that pay a fixed distribution at regular intervals — more specifically when a fund doesn’t earn enough to cover that preset amount. This type of distribution represents money put into a fund being returned to investors and while they are tax-free, they do have tax implications.

ROC distributions reduce the adjusted cost base (ACB) of fund units held by investors, which leads to a higher capital gain (or smaller capital loss) when the investment is sold.

Capital losses can be used to offset capital gains and the remaining net gains must be distributed to unitholders. If the ACB turns negative, capital gains tax must be paid on the amount below zero.

My fund is down, so why did I get a distribution?

Regardless of whether a fund’s price or net asset value per unit (NAVPU) goes up or down, unitholders receive a share of any income earned by the securities held in the fund. This is because changes in the prices of underlying securities that drive the NAVPU are separate from income earned on those holdings.

Since funds are a flow-through product, they must distribute realized net income to unitholders of record every year. When investors receive their share of the fund’s earnings via distributions, they will be taxed on that return based on their individual tax rates and circumstances.

In addition to any income earned by the stocks and/or bonds in the fund, the portfolio managers buy and sell securities as they come into or fall out of favour and also have to sell in order to honour redemption requests. These transactions will trigger capital gains or losses. If sold at a profit, the fund will have a capital gain on that transaction and if sold at a loss, there will be a capital loss.

If capital gains exceed capital losses then the fund will distribute that net capital gain; however, if there is a net capital loss, then this will be carried forward to offset future capital gains.

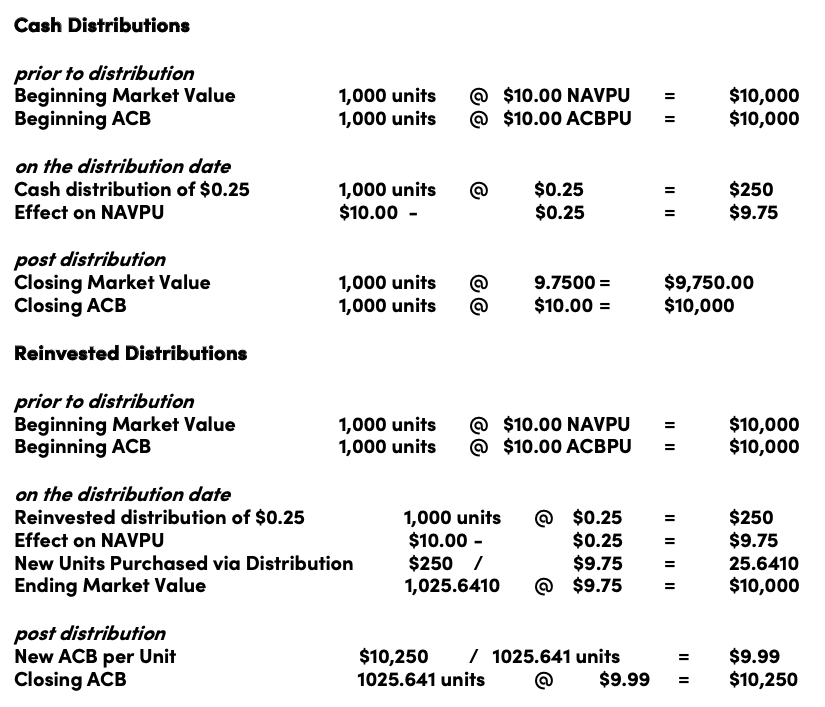

How distributions affect fund holdings

Distributions affect your mutual fund holdings in different ways. They can impact the NAVPU or price of your funds and, if reinvested, your ACB, which is sometimes referred to as book value. Reinvested distributions also alter the number of units held, since the NAVPU drops and the investor receives additional units.

Reinvested distributions increase an investor’s ACB, which may reduce capital gains or increase capital losses. Since distributions are taxable, investors do not pay tax again on those distribution amounts, at the time of sale. Meanwhile, cash distributions have no impact on an investor’s ACB.

Take the example below:

The full tax impact depends on the type of distribution received (interest, dividends, or capital gains) and will be reflected on year-end tax slips sent to investors.

Tax slips

Unitholders receive tax slips from the fund companies, which indicate the types and amounts of fund income received, including from distributions.

The T3 tax slip (Relevé 16 in Quebec) shows interest, dividends, capital gains, return of capital and foreign income received during the year, as well as any foreign income taxes paid. Relevant amounts for any dividends eligible for the dividend tax credit will also be indicated on this slip.

The T5 tax slip (Relevé 3 in Quebec), or Statement of Investment Income, is issued to investors who own units of a mutual fund corporation. It too indicates the various amounts and types of income received by unitholders.

A few reminders

Tax slips are sent by the mutual fund companies and not CRA. There are deadlines by which they must be sent, so that unitholders can complete their tax returns on time.

Distribution income gets taxed based on an investor’s tax rate and circumstances. Individual situations vary, which is why professional investment and tax advice are always recommended.