An investment manager will fine-tune a client’s bond portfolio from time to time, moving from one sector to another using a sector rotation strategy to take advantage of the best performers in the market. It is a demanding task as the manager has to weigh a combination of data involving historical norms, supply and demand and credit factors.

Sector Rotation Strategy: Bonds

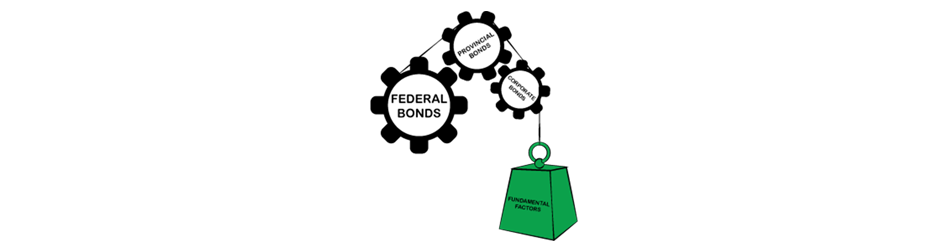

A sector rotation strategy for bonds involves varying the allocation or percentage “weights” of different types of bonds held within a portfolio.

An investment manager will form an opinion of the valuation of a specific sector of the bond market, based on the credit fundamental factors for that area, relative valuations compared to historical norms and technical factors such as supply and demand within that sector. A manager will usually compare her portfolio to the weightings of the benchmark index or “bogey” that she is being compared to on a performance basis.

For example, a Canadian bond manager might feel that provincial bonds are historically cheap compared to federal government bonds. The manager would run a historical comparison of the difference in interest rates or “yield spread” between various terms of provincial and Canada bonds and compare these levels to historical norms. If the interest rate on provincial bonds was relatively high compared to historical levels, the manager would consider them to be “cheap”. The manager would then consider the fundamental factors, such as tax revenues, budgetary issues and even political developments and then “overweight” provincials versus their index weight. She would also take into account technical issues such as prospective new issues and the financing requirements of the provincial governments. The demand for provincial bonds would also be important, as they are high quality and higher yielding investments for financial institutions such as insurance companies and banks. If their preferred investment such as mortgages and commercial loans are in short supply, they will use substitutes such as provincial bonds. This same technique is used to allocate weightings in the portfolio between other types of bonds such as corporates, municipals and asset-backed securities.