While interest rate changes directly affect variable mortgages, for fixed-mortgage rates, the key is actually what’s happening in the bond market.

That’s because lenders tie fixed rate mortgage rates to bond rates – so the connection to interest rate movements is a bit more complicated.

A bond and a mortgage are both loans made to the borrower.

In the case of a bond, the bond investor is making a loan to the company.

In the case of a mortgage, the bank is making a loan to the mortgage borrower.

The company that issues a bond and the person who takes out a mortgage both need money that they don’t have to buy or do something.

They get that money from a lender under certain terms, that being the bank or bond investors.

In both cases, the goal of the lender is to make money on that loan, through interest rate payments.

The interest rate on a bond is its yield, and on the type of mortgage we’re talking about, it’s the mortgage rate.

Bond yields are plotted on what’s known as the yield curve, which plots interest rates and maturities for bonds of equal credit quality. A normal yield curve should slope up, because bond yields should go up as time passes.

Bond yields represent the cost of borrowing in the broader financial market.

Lenders, such as banks, rely on the bond market to gauge the cost of long-term borrowing. When bond yields rise, it becomes more expensive for these institutions to borrow money themselves or to secure funding.

To maintain their profit margins and cover higher borrowing costs, lenders pass this increased cost onto consumers by raising fixed mortgage rates.

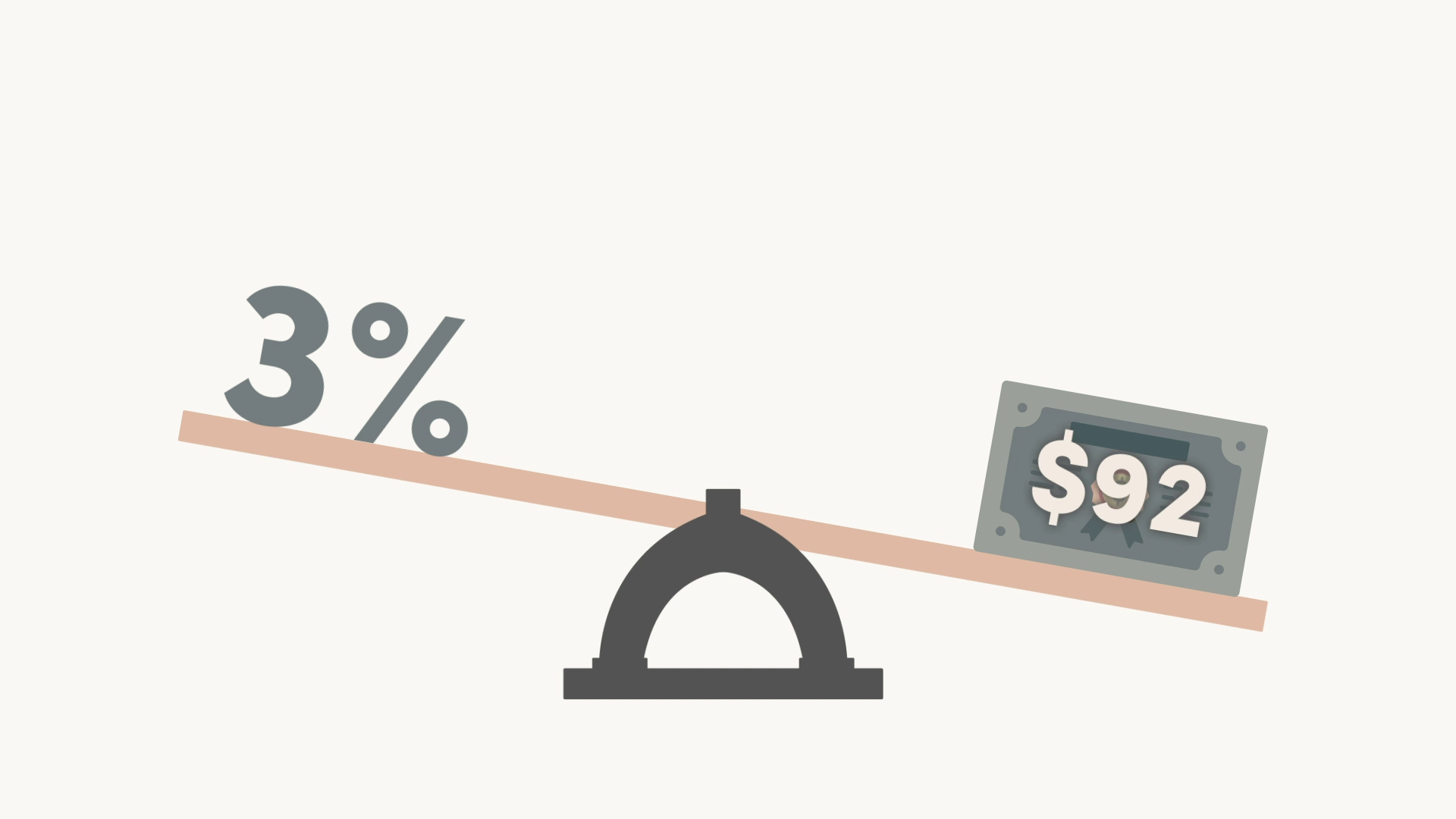

Bond prices have an inverse relationship to interest rates, so when rates go down, bond prices go up – and vice versa.

But bond yields and interest rates move in tandem.

And because banks and other lenders use bond yields to determine fixed-mortgage rates, low bond yields mean low interest rates on fixed mortgages.

When bond yields climb, fixed-mortgage rates tend to follow.

That’s why it’s not current interest rates that can tell you what will happen with fixed mortgage rates, but rather an understanding of what’s coming down the line for the bond market and the bond yields plotted on the yield curve.