Any investor hoping to construct a well-balanced portfolio that includes Canadian equity content should ensure a dividend-paying strategy is a key part of that investment strategy. The theoretical arguments are clear that both dividend paying and non-dividend paying Canadian equities offer investors advantages; however, careful consideration of the empirical evidence reveals that investing in dividend paying stocks isn’t just a good idea – it’s something all Canadians should be actively pursuing.

Any investor hoping to construct a well-balanced portfolio that includes Canadian equity content should ensure a dividend-paying strategy is a key part of that investment strategy.The theoretical arguments are clear that both dividend paying and non-dividend paying Canadian equities offer investors advantages; however, careful consideration of the empirical evidence reveals that investing in dividend paying stocks isn’t just a good idea – it’s something all Canadians should be actively pursuing.

If you compare Canadian dividend paying stocks to non-payers (as defined by those stocks or equities that comprise the S&P/TSX Composite Index), you’ll find that generally dividend payers offer superior risk and return prospects.

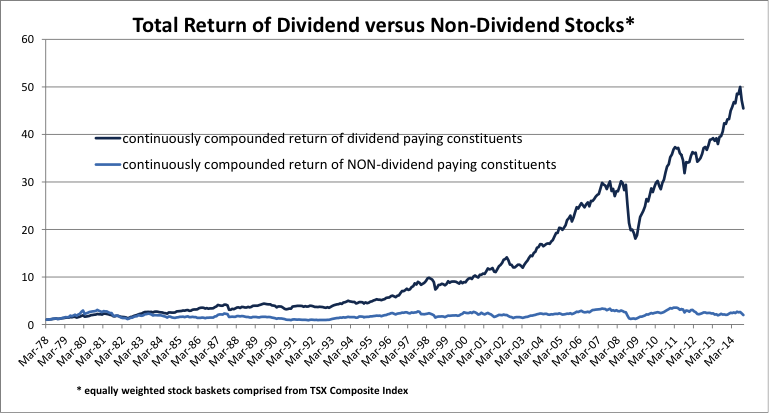

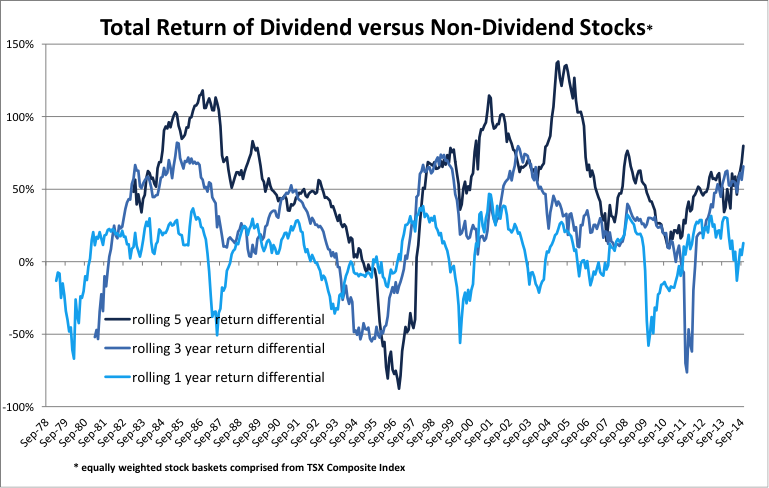

If given the data, one can easily compare the risk and return of an equally weighted portfolio of the entire dividend-paying universe of securities from within the S&P/TSX Composite Index with the risk and return of an equally weighted basket of the non-dividend paying equity securities from the same universe.

If the two portfolios were passively held from April of 19781 and rebalanced monthly to remain equally weighted (and to remove capitalization bias), the equally weighted portfolio of dividend-payers outperformed the equally weighted portfolio of non-dividend-payers by 9.1% annually, paying the investor 23 times the return for the holding period.

Obviously one should expect periods of outperformance by the non-dividend paying stock universe and in fact that is what we observed, but the majority (or about 64%) of all rolling one-year periods showed outperformance by the dividend-paying basket. In fact, about 85% of all rolling three-year periods (and approximately 91% of all rolling five-year periods) yielded superior returns for dividend payers.

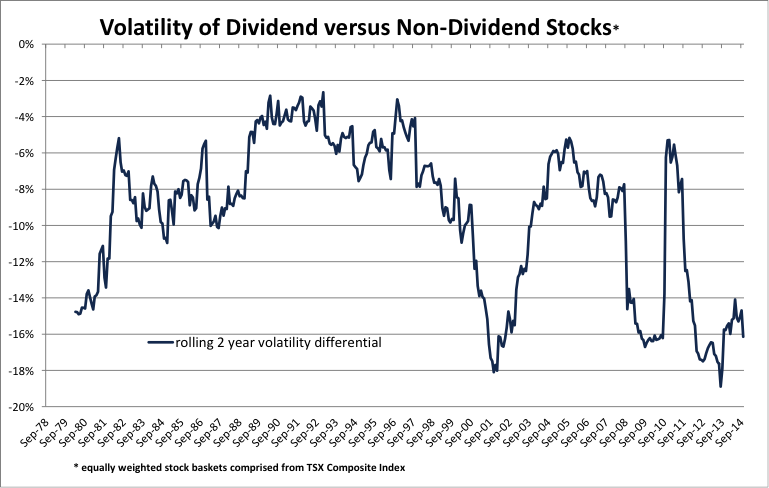

While the returns of the dividend-paying universe are compelling in and of themselves investors also need to consider the risk per unit of return when constructing any portfolio. The risk as measured by the volatility of the portfolio returns expressed in annualized terms is far less for dividend paying stocks than it is for non-dividend paying stocks.

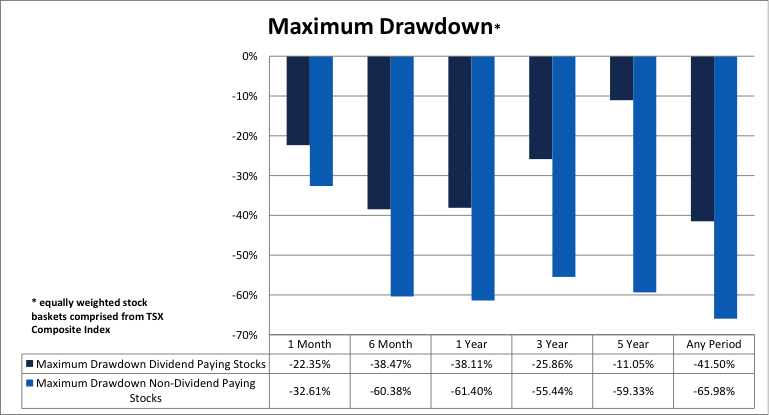

Investment professionals also consider a measure of risk known as “maximum drawdown,” or the greatest negative percentage returns for any given period. It is an additional and complimentary lens to volatility as a measure of risk.

In our data set, the maximum drawdowns were substantively less for the equally weighted dividend-paying universe than the non-dividend-paying universe, where “universe” are the stocks from within the S&P/TSX Composite Index, divided into dividend paying versus non-dividend paying.

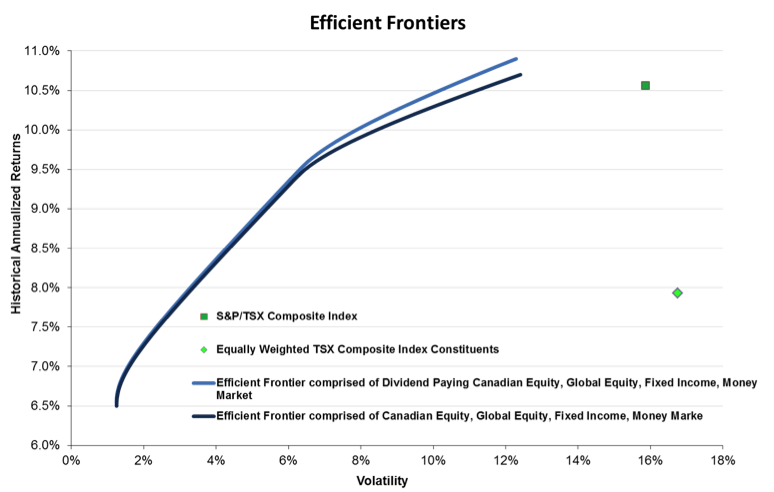

One final risk/return approach is to consider the impact of the addition of Canadian equity to a portfolio of diversified assets. For this exercise two efficient frontiers were constructed from traditional asset classes (money market, fixed income, global equity and Canadian equity).

Not surprisingly we found that the frontier that uses the equally weighted dividend paying stock basket in lieu of the S&P/TSX Composite Index as representation of the Canadian equity component of the diversified basket, provided the superior compliment to the global portfolio yielding a superior risk/return trade-off set.

The empirical evidence is powerful and any investor in Canadian equities should consider a dividend strategy for a portion of Canadian equity investment when trying to build a diversified portfolio.

The official white paper report is available through Crusader Asset Management.

1. This is a considerable or lengthy period of time for which data were available to the author.