When everyone seems to be jumping on an exciting new investment, it’s hard to resist the urge to join in. But as bitcoin has shown, there are huge risks to diving into a volatile investment category without knowing what you’re getting into.

Bitcoin, pegged by its supporters as the “it investment” of 2017, appears to have turned into a cautionary tale about what happens when you invest in something that has no intrinsic value.

When price hasn’t been driven up by fundamentals, it is vulnerable to a crash – and when that crash comes, there’s no saying how low the price drop can be because the asset’s value isn’t based on anything tangible.

Bitcoin rose largely on hype and speculation. People got excited about what seemed like easy money, and wanted in.

But to many experienced investors, it looked a lot like a financial mania, which after peaking in December 2017 at $19,511, fell by more than 65 per cent in early 2018 amid questions about its worth, sustainability and trustworthiness.

As a new asset class, bitcoin also wasn’t regulated.

By the time agencies like the U.S. Securities and Exchange Commission and the Ontario Securities Commission began studying the implications of investing in cryptocurrencies, investors had already bought into dozens of initial coin offerings.

But while initial coin offerings acted like stock offerings, these ICOs didn’t have any intrinsic value. You weren’t buying a part of a company you could study and value, as you would with a stock. You were simply buying the digital tokens offered by that particular company, which you could then use to buy certain goods and services.

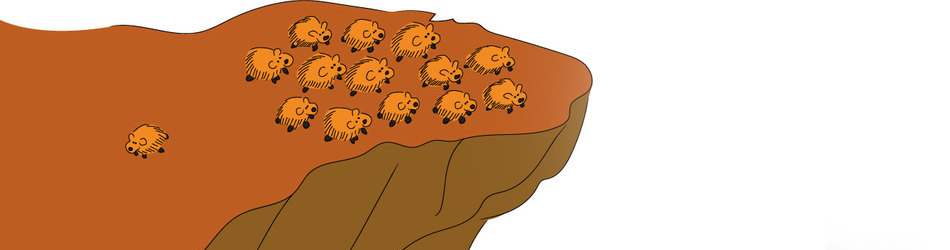

The whole thing looked a lot like a house of cards ready to fall at any moment, not unlike the dot-com bubble that wiped out $5 trillion dollars in market value for tech companies in 2000, or the Dutch tulip bubble of 1637.

Investors considering bitcoin or other fad investments should look to bitcoin and other manias for the important lesson they offer: While fear of missing out can be a hard feeling to fight, in the world of investing it’s always wise to think, research and watch before letting your emotions lead you down the wrong path.