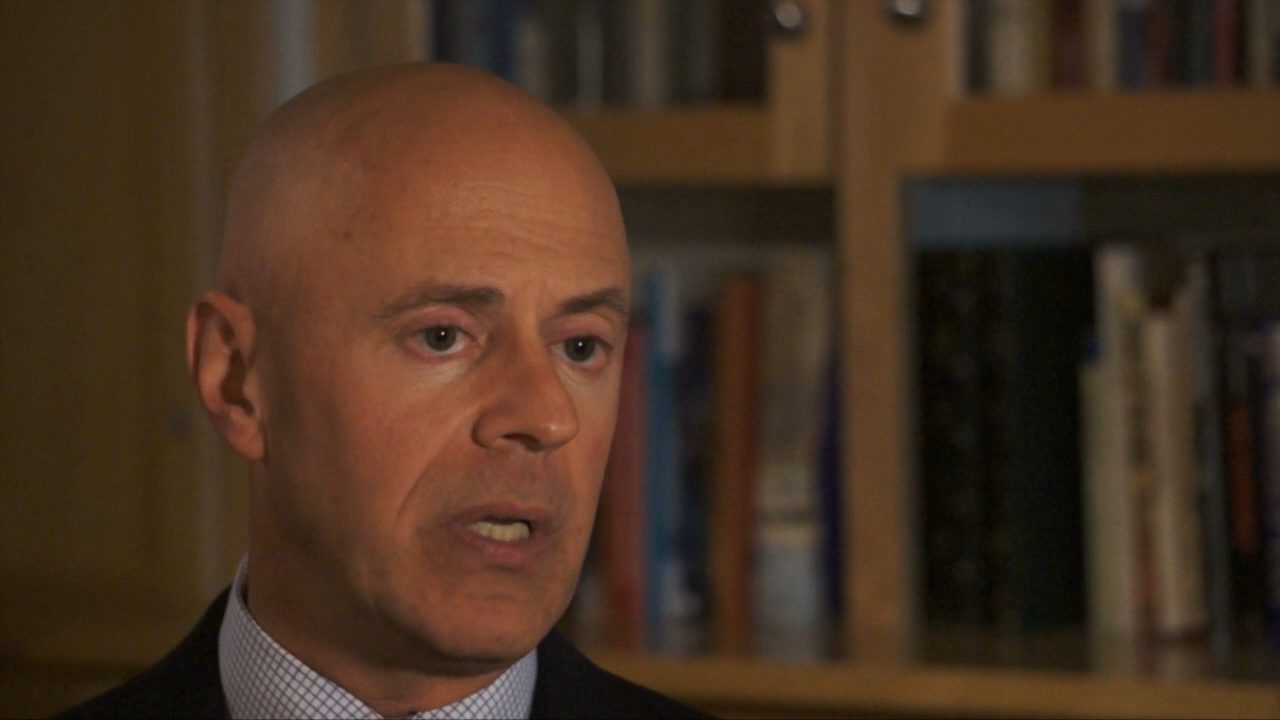

There are good reasons why the era of cheap money is coming to an end in the U.S. Paul Taylor, senior vice president and chief investment officer asset allocation with BMO Global Asset Management, told Financial Pipeline editor Malcolm Morrison that a major factor is the fact that the American economy is performing so much better.

PT: The current Fed policy is inconsistent with the pace of economic growth in the United States of America. The policy was put in place post the great financial crisis, which was appropriate. We need to have extraordinarily accommodative policy to stimulate the U.S. economy. But that was then and this is now. You know our latest print for the second quarter of 2015 on growth was almost four per cent in terms of economic growth. So these extraordinarily accommodative conditions are inconsistent with the current pace of U.S. economic growth. That being said, as you infer Malcolm, where we are in terms of economic growth, it’s still a tenuous recovery. There are still issues out there that loom large with the Fed, rightly so does need to consider.