Guaranteed Investment Certificates or GICs offer a guaranteed rate of return over a fixed timeframe. They are useful vehicles for investors who want an ultra-safe place to put their money and don’t mind that it is usually locked up for set periods of time.

The biggest upside of GICs is safety; the principal is protected and would only be at risk if the bank or trust company where you bought them defaulted. In that case, your investment in GICs would be covered by Canada Deposit Insurance Corporation, or CDIC, which offers protection of up to $100,000.

Another positive is that it doesn’t take a lot of money to get into this investment vehicle; usual minimums are $500 to $1,000.

The downside is the fact that because of the minimal risk of owning GICs, the return is generally a lot less than for bonds, stocks and mutual funds. On the other hand, the return on GICs will often be more than a bank savings account

GICs Offer Lots of Choices

Banks and trust companies offer Guaranteed Investment Certificates in terms ranging from 30 days to five years.

They fall into two main categories, redeemable and non-redeemable. The big difference is the amount of interest paid in that you will pay a penalty for the convenience of being able to cash out when you want.

In late 2015, Royal Bank of Canada offered non-redeemable GICs paying an annual interest rate of 0.9 per cent for a one-year term, moving up to 1.5 per cent for a five year certificate. Bailing early on a non-redeemable GIC means you may have to pay a penalty or charge. You may also forego any interest due.

Redeemables will yield you much less, around a third. RBC was offering redeemable GICs for a rather lower interest rate. A one-year GIC was posted at 0.65 per cent, for instance, while the five-year term stood at 0.95 per cent.

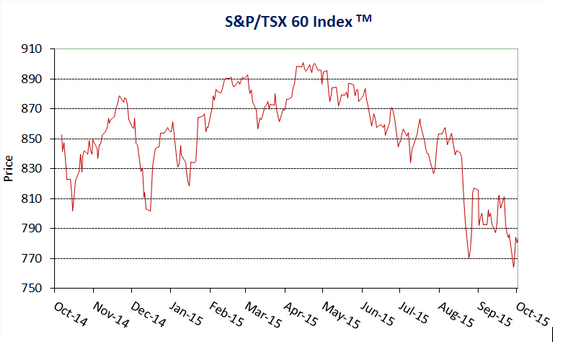

Financial institutions have been offering a greater variety of GICs in recent years. For example, CIBC offers a non-redeemable GIC linked to the Toronto stock market. Its Stock Market Advantage GIC is tied to the S&P/TSX 60 index, which tracks the performance of 60 of the biggest Canadian companies. Your principal is guaranteed – but your return is pegged to the performance of that index. The GICs are sold in three and five year terms.

RBC has another product which is tied to the performance of the prime interest rate, the rate banks charge their best customers, which stood at 2.7 per cent in late 2015.

There are several other GIC vehicles offered by financial institutions so it pays to shop around to find the one that’s right for you.

Also, banks may offer more favourable GIC terms depending on the amount of money you plan to invest. Be sure to ask for the best rates.

The Danger of Higher Interest Rates

Like any other fixed-income investments, such as bonds, the GIC investor can find herself exposed to changes in interest rates. The best way to protect yourself is to take a “laddered” approach to GICs. That means spreading your money out in various terms. Discuss this with your financial advisor and give a lot of thought to when you might have to access that money.

Tax Treatment

Gains on GICs are fully taxable. The good news is they are suitable for RSP and TFSA accounts.

As always, discuss any investment decisions with your advisor. And if you don’t have one, get one. Preferably, a fee-only advisor.