Investors have been told time and again that their worst enemy can be themselves because they let emotion control their stock choices.

It’s never a good idea, for instance, to buy a coffee chain’s shares because they make a fine cup of Joe, or a retailer’s stock because you like their appliances.

But this emotion just doesn’t apply to buying – it’s right there when it comes to the time to sell shares as well.

Some people find selling easy, sticking to the old adage of ‘Sell in May and Go Away (until September)’. But many people find that divestment, the opposite of investment, is tougher.

We’re not talking about regularly dumping investments and diving into something else. For example, it still makes sense to buy and hold top-notch investments such as the big Canadian banks.

But perhaps you bought an airline’s stock years ago. The carrier’s stock since then has been crushed by a competitor that wasn’t even on the horizon when you hit the buy button. There are plenty of compelling reasons to divest and cut your losses – but you just can’t bring yourself to do it because emotion is overriding logic.

In such cases, you have to remember that kind of thinking is very unhealthy for your financial health.

“When failure is demonized, people will try to avoid it at all costs—even when it represents nothing more than a temporary setback.” Steven D. Levitt

“Resources are not infinite: you cannot solve tomorrow’s problem if you aren’t willing to abandon today’s dud.” Steven D. Levitt

“You have to be able to say, ‘It’s a dog, it’s not going anywhere, the prospects aren’t there, I made a mistake, best to get out as best I can’,” said Adrian Mastracci, a fee-only portfolio manager at KCM Wealth Management in Vancouver.

“Every loss you incur always starts out small.”

Even when investors can be persuaded to sell, they sometimes have a hard time making a final parting.

“If you get some legacy stuff, things you bought in the past, I find they’re willing to let, say, half of them go, and the other half, (they’ll say) `keep them for another six months, let’s see how they do,’” Mastracci said.

Why half?

“They don’t want to say, ‘I was completely wrong,’” he said.”

“‘I was half right’ (saves) face.”

Arguably the biggest hurdle to divestment is the fear that the timing will be completely wrong and the stock will end up going up in value after it is sold. But according to Mastracci, you can’t let that stop you.

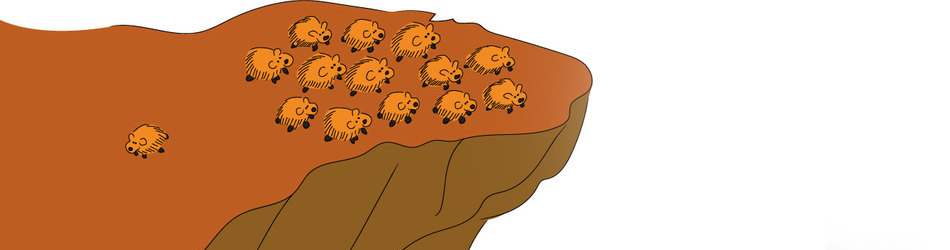

“Because we’re usually selling more than one, there’s that cockroach theory – there’s always more than one in the pool.”

What he advises is to have a six-month game plan to get rid of “the bad stuff” – securities that fit the investor’s profile at one point but not anymore.

“Most people will say, ‘OK, that gives me enough time to weed out the stuff and have my hand in it,’” he said.

“You just have to be realistic with clients and say, ‘this doesn’t fit and here’s what we’re going to do. Six months from now your portfolio will look a lot different – you will be a lot happier but we have to start’.”

“All through time, people have basically acted and reacted the same way in the market as a result of greed, fear, ignorance, and hope. That is why the numerical formations and patterns recur on a constant basis. Over and over, with slight variations. Because markets are driven by humans and human nature never changes.” Jesse Lauriston Livermore

There are other investors that realize their stock could suddenly tank – a situation where the security has dropped, say, 10 per cent and they don’t want to sustain further losses.

There are a variety of tools that these investors can use for divestment. They include:

Stop Loss Order

Let’s say your stock in ABC Corp. has dropped 10 per cent and you are unwilling to sustain further losses. If you previously made arrangements with your broker to automatically sell the stock once it lost that amount, there’s nothing you need to do. This saves you from having to get involved when there’s a drop, but the downside to this is that the decline could be a short-term aberration, and when the price shoots back up you realize you no longer hold that stock.

Market Order

An investor makes such an order through a broker or brokerage service to buy or sell a set number of securities at the best price available.

Limit Order

In this case, a client sets a specific price at which the trade – buy or sell – may be executed. The trader will make the move at the predetermined price, or at a better price if he’s able to obtain it.