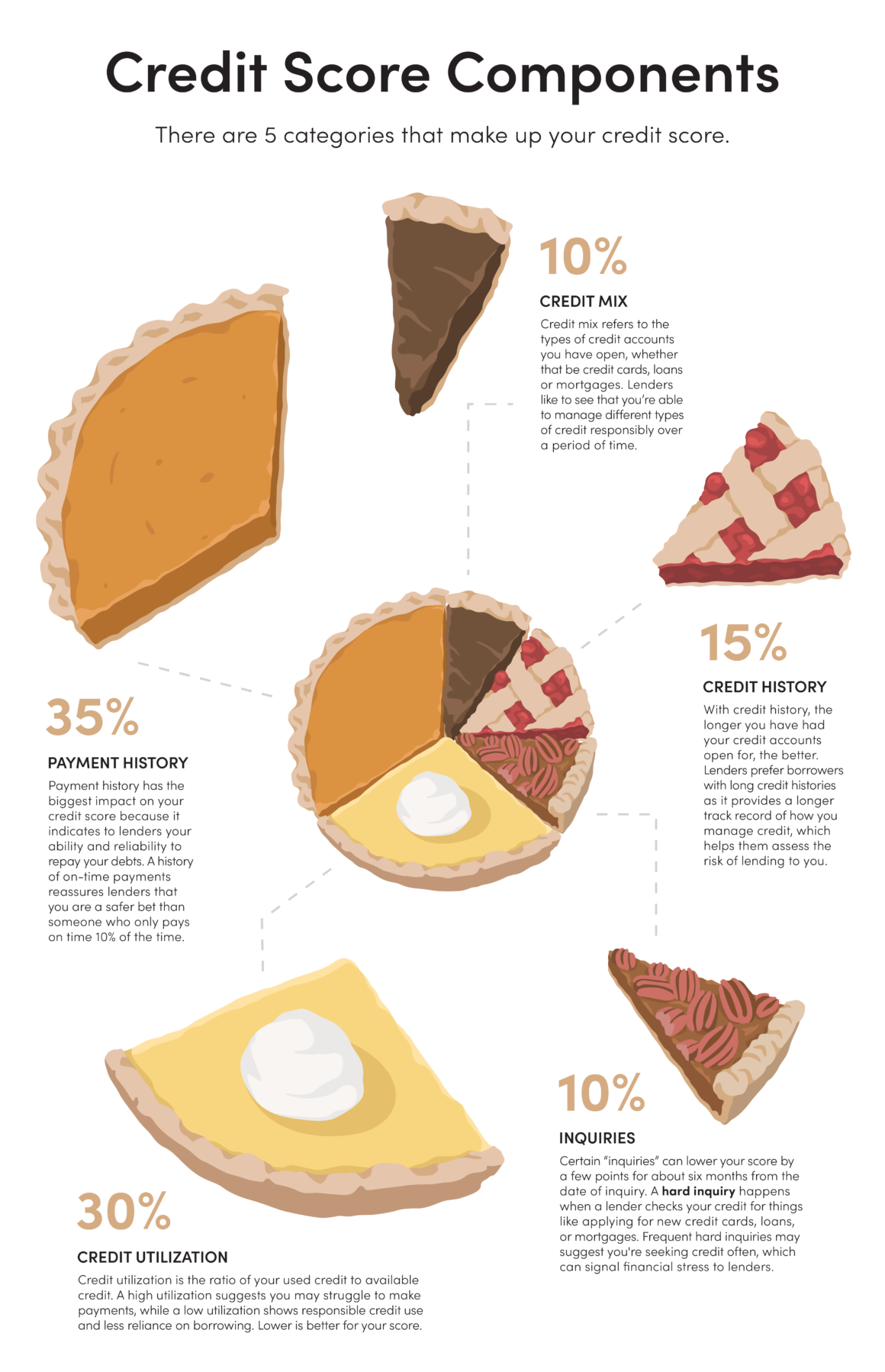

Your credit score is calculated based on five components, each weighted differently.

Payment History

Payment history has the biggest impact on your credit score because it indicates to lenders your ability and reliability to repay your debts. A history of on-time payments reassures lenders that you are a safer bet than someone who only pays on time 10% of the time.

Credit Utilization

Credit utilization is the ratio of your used credit to available credit. A high utilization suggests you may struggle to make payments, while a low utilization shows responsible credit use and less reliance on borrowing. Lower is better for your score.

Credit Mix

Credit mix refers to the types of credit accounts you have open, whether that be credit cards, loans or mortgages. Lenders like to see that you’re able to manage different types of credit responsibly over a period of time.

Credit History

With credit history, the longer you have had your credit accounts open for, the better. Lenders prefer borrowers with long credit histories as it provides a longer track record of how you manage credit, which helps them assess the risk of lending to you.

Inquiries

Certain “inquiries” can lower your score by a few points for about six months from the date of inquiry. A hard inquiry happens when a lender checks your credit for things like applying for new credit cards, loans, or mortgages. Frequent hard inquiries may suggest you’re seeking credit often, which can signal financial stress to lenders.